GE: Amping Up Energy Storage

By: Ryan Cheng & Ben Ballyk

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

The Fall of GE

In August 2000, General Electric (GE) was the world’s most valuable company, with a market capitalization of approximately $900 billion in today’s dollars. However, due to a number of poor strategic decisions and difficult external circumstances, their current valuation is just $85 billion. When chronicling GE’s downfall, several key events emerge as drivers of decline. GE Capital was a leading driver of revenues leading up to 2008, but the financial crisis nearly bankrupted the company due to its high risk exposure. Later down the road, GE’s acquisition of Alstom’s coal power business for $9.5 billion in 2015 was largely seen as a strategic failure, as GE exited the coal power business five years later. In September 2020, given the downturn of its aviation segment and the struggles of its coal-focused power segment, GE announced plans to focus on wind power.

GE’s Strategy and the Winds of Change

GE’s decision to pivot from coal to renewables is supported by the industry’s anticipated growth: the renewable energy market is poised to grow 6.1 percent annually from $928 billion in 2017 to $1.5 trillion in 2025. This growth is largely attributable to declining costs and rising generation capacity. The wind turbine market is positioned to grow even faster at 7.2 percent annually from 2017 to 2023. GE’s renewable energy segment is predominantly focused on onshore and offshore wind turbine manufacturing, and the company recently sold its solar energy business to streamline operations. GE is relatively well-positioned within the industry, ranking fourth in market share with 10 percent.

To grow its wind turbine market share, GE’s main strategy has been to make improvements to the size and efficiency of its turbines. However, potential growth in efficiency is limited as existing wind turbines have already reached 80 percent of the maximum theoretical limit on energy efficiency. In addition, current trends indicate that global renewable energy generation is increasing faster than global renewable energy use. GE has cited increasing competition and the resulting pricing pressure as a root cause for the decline in the profitability of its renewable energy unit from a $728 million profit in 2017 to a $666 million loss in 2019. Technological limits have also severely constrained GE’s growth potential within the market. Given these constraints, as well as management’s commitment to the renewable energy unit, GE should look to explore new, high-potential renewables markets.

Energy Storage: A AAA Market

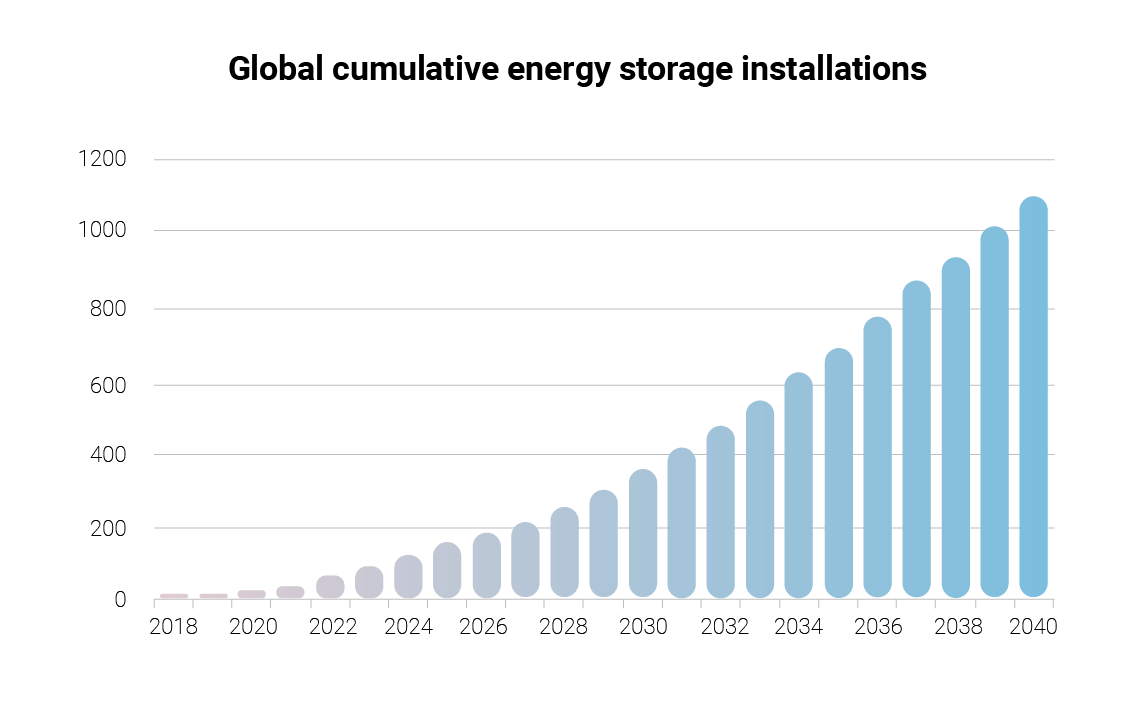

In recent years, the energy storage market, including utility-scale batteries, has seen considerable growth and investment. The market is projected to grow from $2.9 billion in 2020 to over $103 billion in installation revenues by 2030 . The main market drivers have been economies of scale and the popularity of electric vehicles, which have led to a drop in lithium-ion battery prices by over 80 percent from 2010 to 2019. Demand for energy storage has also increased significantly due to growing interest in renewable energy sources as well as grid modernization and stabilization.

Energy storage products help store energy during periods of peak generation and subsequently release energy as it is demanded. They stabilize the volatility of renewable energy generation and allow utility companies to avoid expensive curtailments. Typically, curtailments occur when producers limit energy production to either bring supply closer to demand or to handle grid congestion, where the amount of power transmitted from one line to another needs to be controlled. This costly process is implemented when there is more electricity being produced than can feasibly be stored in batteries or consumed.

The Short-Comings of Short-Term Batteries

While companies like Tesla, Samsung, and LG Chem have doubled down on their commitment to lithium-ion batteries, experts predict that lithium is not economically efficient enough to operate on the growing grid. As these batteries can only provide six hours of electricity, they are ultimately short-duration energy storage systems. In comparison, emerging, long-duration storage systems such as flow batteries and thermal storage provide over 10 hours of energy.

Another important characteristic of grid-scale batteries is the energy capacity cost, measured in dollars per kilowatt-hour (kWh). When comparing batteries, these costs tend to be significantly higher for short-duration batteries relative to long-duration. A study conducted in the Energy & Environmental Science journal shows that powering 80 percent of the U.S. grid with wind and solar would require either an expensive nationwide high-speed transmission system, or it would limit the whole system to just 12 hours of energy storage. If this transition to renewable energy was implemented with lithium-ion batteries, it would cost over $2.5 trillion, or 12 percent of the U.S. GDP. In the state of California, if the share of renewable energy increases from 50 to 100 percent by 2045, the cost per megawatt-hour (MWh) would rise exponentially from $49 to $1,612 per MWh given today’s short-duration lithium-ion prices.

Fortunately, awareness about the importance of long-duration energy storage is on the rise. Recently, the California Energy Commission established a $20 million fund for investing in non-lithium-ion long-duration energy storage. The U.S. The Department of Energy also announced a $30 million project to fund battery research projects, citing a need for technologies that cost less and last longer than lithium-ion. Globally, Bloomberg predicts that 305 gigawatt-hours of energy storage will be installed between 2016 and 2030, which would be 2,364 times the size of Tesla’s world-record-breaking installation in Australia.

Long Duration, Long Overdue

Currently, GE’s main energy storage product is Reservoir, a lithium-ion battery. However, given lithium-ion’s inability to meet the storage needs of the future, GE should shift its focus from lithium-ion to a greater, sustainable opportunity: long-duration energy storage systems. Currently, the most prominent long-duration battery type is vanadium flow, which is forecasted to account for 30 percent of the storage market by 2025. In comparison to lithium-ion batteries which degrade after a few thousand charging cycles, vanadium flow batteries can be recharged up to 20,000 times without performance declines and are expected to last decades.

Batteries Not Included

Long-duration storage start-ups have struggled due to significant capital requirements for R&D. This lack of capital means that many of these companies have gone out of business before getting a chance to prove their concept in the market. This is where GE, with its significant size, capital and manufacturing scope can step in.

In 2019, GE sold off various poorly performing business segments to strengthen its balance sheet. As of September 30th, 2020, GE boasted nearly $40 billion in cash with 91 percent of its $80 billion in bank loans maturing after 2021. GE, with nearly $3.5 billion worth of investments in its GE Ventures portfolio as of 2019 has the capacity to make significant investments in various long-duration storage startups. Flow battery makers such as ESS and Primus Power have each raised $47 million and $110 million, respectively, and are actively seeking investments. GE can act as a strategic partner for such startups, supporting their manufacturing and R&D needs, while hedging against the risk of a single technology failing. If an investment successfully demonstrates a powerful proof of concept, GE can help finance manufacturing costs to establish a dominant industry player.

Tailwinds Ahead

As a leading manufacturer in the wind turbine market, there is an opportune case for vertical integration by pairing a long-duration storage system with GE’s existing onshore wind turbines. Large-scale wind-plus-storage and solar-plus-storage have typically faced challenges due to the constraints of lithium-ion batteries. In particular, curtailments are becoming a significant issue for governments committed to renewable energy. For one example, the U.S. had to curtail about two percent of wind generation in 2018. Within the U.S., Texas had to curtail an astounding eight percent of solar generation in 2018. Emerging long-duration technology would change the scope of the market by reducing expensive energy curtailments and decreasing installation costs for producers.

Charging for a Brighter Future

As pricing pressures and market saturation look to threaten its position in the wind turbine market, GE is once again at a key strategic fork in the road. Investing in the saturated wind turbine market will have diminishing returns, and targeting short-duration lithium-ion batteries would be expensive and difficult. However, capitalizing on its size and expertise, GE should look to the promising future of long-duration energy storage systems. While long-duration storage startups lack the infrastructure to prove commercial viability, GE can utilize its asset base and manufacturing capabilities as a launchpad for these technologies. Whether it is pairing wind and solar with storage, or improving grid reliability and stability, the robustness of a long-duration storage system will allow for a wide range of uses. As governments aggressively pursue agendas of climate sustainability and clean energy, the need for long-duration storage is not a question of if, but when.