Epic Games: The Pass to the Metaverse

By: Kenneth Wong & Jason Purnoko

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

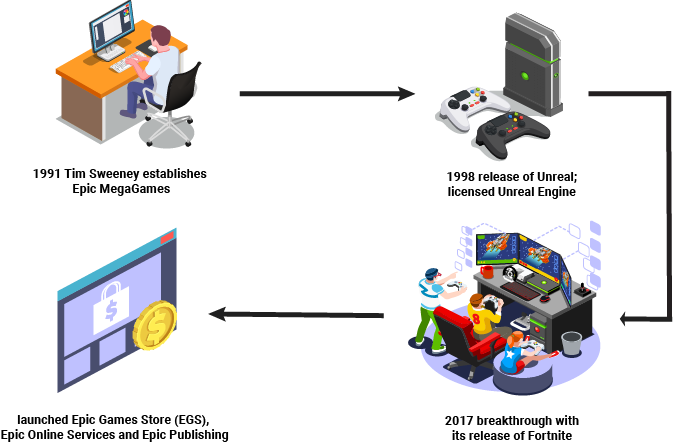

An Epic Takeover

Epic Games Inc. (Epic), a leading video game developer and publisher, was founded by CEO Tim Sweeney in 1991. Previously best known for its Unreal and Gears of War franchises, Epic broke into mainstream pop culture in 2017 with the release of Fortnite and the game’s signature battle royale mode. Amassing over 350 million players in the subsequent three years, Fortnite now has one of the largest active player bases of any game. Capitalizing on Fortnite’s success, Epic launched its online game storefront, the Epic Games Store (EGS) in 2018, and made the EGS the sole platform where users could launch and play Fortnite. Soon after, Epic also launched Epic Online Services and Epic Publishing to expand its reach across the entire gaming value chain. Pursuing this vertically integrated business model was a key step in bringing Tim Sweeney’s vision for Epic Games to life: creating a highly-integrated virtual space for all to enjoy.

Dropping In

Since its founding, Epic Games has had a track record of adopting unconventional strategies, disrupting industry leaders and working to level the playing field in favour of small developers.

With his first game, ZZT, Sweeney adopted a “shareware” strategy rather than opting for a traditional retail strategy. Historically, a shareware model allowed developers to self-publish and release large parts of their games for free, allowing gamers to experience the product before choosing to pay the developer for the remaining segments. Through this model, Epic retained the vast majority of revenue, avoiding mandatory fees to publishers and retailers which could have represented up to 85 percent of revenue.

The company hit a major breakthrough in 1998 with the release of Unreal, a massively successful 3D shooter game revolutionary for its graphics and ability to handle large, highly detailed environments. Having recognized the growing technical complexities associated with game development, Epic began to license the core technology behind the game to other developers, naming the resultant tool the Unreal Engine after the game that inspired its existence. Gaming engines like the Unreal Engine provide tools to create games with advanced graphics and gameplay, from simple lighting and rendering to object collision and complex physics. This prevents creators from needing to build a development environment from scratch, resulting in significant time and cost savings.

Playing The Long Game

In 2015, Epic made the controversial decision to stop charging a licensing fee for use of the Unreal Engine, opting instead for a significantly more accessible five percent royalty on future revenues. The company recognized that game development had high technical barriers to entry which continued to skew the playing field against small, independent (“indie”) game developers. This decision allowed Epic to lower both the technical and financial barriers to development, enabling small, bootstrapped developers to produce high-quality games for a broad market. Supporting indie developers and democratizing the gaming industry are some of Epic’s primary goals as a company, demonstrated by several of the company’s recent strategic initiatives.

Competing for Attention

Despite Epic’s success with Fortnite and the Unreal Engine, one significant obstacle stands in the way of Tim Sweeney’s goals. Epic has only published one blockbuster game in the past decade: Fortnite. Though Fortnite has been wildly successful, this has constrained Epic’s available channels to interact with consumers, while other game publishers like Electronic Arts and Activision Blizzard consistently publish highly successful (if less popular) titles on an annual basis. The concentration of Epic’s customer base in Fortnite will make retaining player interest challenging. Even if Fortnite is able to remain relevant for years like League of Legends or Counter-Strike: Global Offensive, Epic’s 2020 lawsuit with Apple highlights the risk presented by this lack of diversification. The Apple-Epic dispute saw Apple pull Fortnite from the iOS App Store, a platform where Epic has grossed $1.2 billion in sales since release. Though Fortnite continues to improve retention through its Battle Pass and pop culture collaborations, Epic should look to diversify its game portfolio by taking on Steam in the PC Gaming storefront market.

Boss Battle: Steam’s Castle

Valve’s Steam is the largest player in the PC Gaming storefront market. As a platform, its business model relies on two-sided network effects: consumers are attracted to the platform by the myriad of games, while developers require a robust user base to justify the development of more titles. The early release of Steam’s game storefront in 2003 allowed it to build a significant first-mover advantage, strengthening its network effects with little competition to ultimately amass a customer base of over 95 million active users and a library of over 30,000 games.

Epic’s current Steam competitor is the EGS, which features over 400 games from both indie and AAA developers. With EGS, Epic retains full control of the value chain, giving the company control over pricing and access to critical consumer insights. Epic has grown the platform through the institution of user-friendly policies—developers are charged a lower distribution fee compared to Steam, and customers are periodically offered free games to keep forever. Despite this, EGS is still in its infancy and will require significant further investment to compete with Steam’s dominance in the space.

EGS’ Unreal Benefits

To more effectively compete with Steam, EGS should introduce a subscription-based games pass that would help to drive expansion and accelerate the platform’s existing two-sided network effect. The Epic Games Pass would allow players to access a variety of games from different developers for $8 per month. Considering a typical game can range from $15 to $80, the game pass subscription is a more financially attractive option for users. Available games would include both indie games and high-budget AAA games from well-established developers. For example, a gamer who plays approximately three AAA games over the span of a year would be paying approximately $180, but the Epic Games Pass would provide access to over 80 games for $96 annually. Setting a successful precedent for the game pass subscription model, Microsoft’s Xbox Games Pass has currently amassed 15 million subscribers over the past three years.

Playing Duos

Through the game pass, Epic can focus on catering to the vast number of independent developers to further incentivize them to operate within the Epic Games ecosystem. Epic’s Unreal Engine is already built with these developers in mind, as demonstrated by the engine’s design and pricing model. Epic can utilize the good relations it has with developers through Epic Games Publishing and the Unreal Engine by waiving Unreal Engine fees for developers willing to publish their games with an exclusivity deal on Epic Games Pass. This strategy will further benefit smaller developers by providing a source of guaranteed revenues and exposure, hedging the major risks that indie developers face. Applying this incentive structure will both increase Epic’s game library and improve customer retention.

While AAA developers already have the resources required to produce games and make large profits, they would still be incentivized to join the Epic Games Pass. AAA games tend to quickly lose steam after their initial release as hype-fueled momentum begins to fade. For example, the critically acclaimed game Sekiro: Shadows Die Twice, released in March 2019, experienced 40 percent of total sales-to-date within its first 10 days of release. Participation in the Epic Games Pass would provide additional revenues and exposure to AAA developers once traditional retail sales begin to stagnate. With many AAA games featuring supplementary downloadable content and in-game items for purchase, developers are incentivized to pursue strategies that increase their player base even if the game is accessed at a vast discount to retail pricing.

By creating an incentive structure that attracts both indie and AAA developers to its platform, Epic will increase customer retention by maintaining a steady stream of new user content in the form of new game releases.

An Opportunity of Epic Proportions

If Epic can capture seven percent of currently registered PC Fortnite players at an $8 per month subscription, Epic will generate an estimated $400 million in revenues annually. Costs will vary because negotiations for pricing for the rights to games will be done on a case-by-case basis with each developer to reach a fair price per game, taking into account varying metrics such as usage and projected demand. Overall, if Epic were to target purchases of 82 indie games and 3 AAA games, it could expect to generate profits of nearly $54 million.

Epic Games: Into the Metaverse

Ultimately, the Epic Games Pass will further Epic’s aims to democratize the gaming industry, further driving growth for indie developers while strengthening its offerings to consumers and unifying their gaming experience on the Epic platform. Importantly, however, it will also help to pave the way for Epic’s ultimate goal in creating the Metaverse: a collective aggregated virtual reality space seamlessly connecting users to different persistent experiences. Predicted to be as revolutionary as the internet, developing this alternate virtual world is an integral element of Tim Sweeney’s vision for Epic Games and is a driving force behind Epic’s strategy of vertical integration. The creation of new economies and the shifting of assets into the meta-world are just the beginnings of possibility with the Metaverse and would unlock enormous value-creation opportunities for participants. Epic Games has clearly been positioning its products to help drive the Metaverse’s creation. From dance competitions to hosting the latest Travis Scott concert, Fortnite is extending its reach outside of the typical definition of a game. In addition, Epic’s Unreal Engine allows for easy interoperability of assets and data, as everything created using Unreal Engine uses the same underlying technical infrastructure. Epic Online Services would provide the infrastructure to power a synchronous, persistent Metaverse while Epic Publishing would support the establishment of relationships with content creators. All existing elements of Epic are integrated towards achieving the greater goal of the Metaverse; however, if Epic will indeed be a major player in the creation of the Metaverse in the distant future, it will need to first unite content producers and consumers on a single, seamless platform. To date, it has not achieved the user nor developer adoption necessary to accomplish this.

The Epic Games Pass can act as the bridge, bolstering customer retention and involvement within the Epic ecosystem over the long-term to provide a stable base of loyal customers around which it can build the Metaverse. Moreover, this stickier consumer base would also further solidify Epic’s relationship with game developers. The larger the network of customers becomes, the more developers will be enticed to create games for the EGS. This strengthened relationship with developers will be particularly advantageous to Epic as it prepares to develop the Metaverse. The Epic Games Pass will strengthen the company’s platform further in the near-term, providing the building blocks necessary to achieve this ultimate goal.

Outlasting The Storm

Overall, the Epic Games Pass would provide Epic the opportunity to develop EGS in a manner that builds on its core strengths and competitive advantages while serving as a perfect complement to Epic’s long-term goals. Epic would be able to maximize social good for the gaming community by supporting indie developers with an additional source of revenue and widespread exposure while also providing end-consumers with a breadth of content at an affordable rate. This strategy would instill a high degree of customer retention within EGS, allowing Epic to control and create its own ecosystem which will outlast the popularity of Fortnite. This will serve as a launching point for Tim Sweeney’s long-term goals; with the Metaverse dream in sight, the Epic Games Pass could be exactly what Epic needs to secure victory.