IGM Financial: Ascendance & Accretion in America

By: Steven Nguyen & Juvhan Nithi

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

A Tale of Two Markets: Canada’s Wealth Management Industry

Canada’s wealth management industry is a market of unique characteristics. The landscape is shaped by high consumer loyalty and established incumbent firms, resulting in low competition and high barriers to entry. This distinctiveness has attracted international firms to enter the Canadian market and compete for market share. The market is projected to undergo a period of intense growth, with a 4 percent CAGR. It encompasses many investment types, including equities, fixed income, and alternatives, further segmented by asset management firm types such as large financial institutions, bulge bracket banks, mutual funds, and ETFs. The Wealth Management industry in Canada can be dissected into two distinct categories: Independent Investment Firms and Big 5 Bank Wealth Management Platforms.

At the onset of the Canadian wealth management industry, independent firms were the only players in the market. As these firms developed into larger institutions, consolidation began to take place. All of the Big Five banks, CIBC, TD, BMO, RBC and Scotiabank, introduced wealth management to their suite of offerings by acquiring existing independent dealers. The wealth management arms of these banks have seen meteoric success as they have begun to develop AUM in the hundreds of billions. Comparatively, few independent investment firms chose to remain as such. As of 2024, the most prominent independent players are the CI Financial Corporation, Fiera Capital and the IGM Group.

IGM: A Farewell to Growth?

IGM Financial is the parent company of a semi-diverse wealth and asset management business suite. It operates with various subsidiaries, sharing the brand and internal resources to realize economies of scale. The most prominent subsidiary is Mackenzie Investments, responsible for all proprietary investments and asset allocation across all asset classes for all Assets Under Advisement (AUA) for the IGM Group. IGM is one of Canada’s largest investment management firms by assets under management, managing $270.4 billion in assets as of December 2024. The firm provides retail and institutional clients with investment solutions and services. IGM’s most significant independent competitor, CI Financial, has nearly tripled their AUM in the past 4 years. IGM must rethink its growth strategy lest it be left in the dust.

All the Wealth We Cannot See: Big 5’s Hidden Advantage

Financial advisors at Canadian Banks have a significant advantage in increasing their client AUM. The larger banks have physical locations every few square kilometres throughout Canada, which only increases in metropolitan areas. Each of these banks services the Canadian population by managing their savings, chequing, mortgages, RRSPs, and many other products. As such, the financial advisors at these banks have a much easier time selling products their Wealth Management divisions offer.

In contrast, independent wealth managers have substantially fewer brick-and-mortar locations across Canada and rely on a vast roster of salespeople to convince financial advisors to sell their products over those of the national banks.

Canadian laws only require a suitability standard for their clients, as they must only make suitable investment recommendations without necessarily prioritizing the client’s best interests. This creates an in-house bias with Canadian banks, enabling their financial advisors to focus on selling in-house products to generate commission. As a result, Canadian private wealth management firms, including IGM Financial, have seen slow growth due to the barriers to selling their products to clients in the same capacity as big banks.

The EBITDA also rises: AUM’s Effect on Wealth Managers’ Economics.

The primary catalyst involved in a wealth manager's EBITDA growth is increasing their AUA/AUM. These financial institutions charge a 90 to 200 bps fee for every dollar under management. Wealth managers not heavily differentiated by their investment capabilities have developed revenue models that rely on fees. Consequently, IGM must begin to invest early into growing its AUM.

A Nation of States: the Fragmented US Wealth Management Landscape

In the United States, competition in the wealth management industry is highly fragmented, with significantly lower barriers to entry than in the Canadian market. The expected CAGR is 18.7 percent for the next five years, 14.7 percent higher than growth in Canada.

Fragmentation in the industry arises from differing business models, target demographics, and service approaches. For instance, large firms like JPMorgan Chase or Morgan Stanley dominate the high-net-worth segment with comprehensive offerings. At the same time, independent RIAs often focus on personalized financial planning for affluent but not ultra-wealthy clients. Meanwhile, fintech companies like Betterment and Wealthfront have captured market share among younger, tech-savvy investors through automated, low-cost solutions. RIAs account for over 14,000 firms nationwide; no single entity holds a dominant market share. This fragmentation compels firms to innovate continuously, offering specialized strategies to differentiate themselves in a crowded market. Despite its size and maturity, the industry is marked by low client loyalty and a highly competitive landscape. Key challenges include adapting to evolving client expectations, incorporating technology, and addressing regulatory changes.

Furthermore, the United States Wealth Management Industry has been incredibly active in M&A over the past few years. This is a direct result of partnerships in this industry aging out and requiring succession plans. Many advisory firms are founded and led by baby boomers, creating urgency for continuity plans as they near retirement. This demographic trend has spurred acquisitions by larger firms and private equity-backed consolidators eager to capitalize on client relationships and asset transfers. In 2023, the market saw a record high of over 350 M&A transactions in the RIA space. Buyers are drawn to stable cash flows, recurring revenues, and the opportunity to scale.

Their Eyes Were Watching North: The Global Desire for Canadian Capital Managers

Recent transactions in the Canadian market demonstrate the increasing appeal of Canadian assets to foreign investors. These deals underscore the value of Canada's regulated and concentrated industries, which often demand significant premiums to access.

Mubadala Capital Take Private of CI Financial (EV: $4.7B)

Mubadala Capital recently announced it would take the CI Financial Corporation private for an equity valuation of $4.7B. Mubadala is the private equity investment arm of the United Arab Emirates Sovereign Wealth Fund. They paid a 33 percent premium on the latest close of the CIX stock and a 58 percent premium over the 60-day volume-weighted average trading price to close the deal. Previous M&A activity in the wealth management industry shows that the typical premium range falls between 20 to 40 percent. In this case, Mubadala paid a significant premium over the industry standard, which can be primarily accredited to the Canadian capital premium. Investors are willing to pay higher amounts than usual to access this market.

Blackstone Acquisition of Tricon Residential (Equity Value: $3.1B)

Earlier this year, Blackstone, a leading private equity firm based in the United States, acquired and privatized Tricon Residential. This was earmarked as a landmark transaction for the Canadian market, exemplifying the increasing investor sentiment for Canadian capital. Tricon manages approximately $8B in real estate assets across North America, with the bulk of its capital base invested in Canadian property.

While Mubadala focused on acquiring a financial services firm to access Canada's wealth management sector, Blackstone targeted real estate assets, reflecting diverse opportunities for foreign investors across industries.

Acquiring American AUM: A Triple A strategy

The United States presents a promising opportunity for expansion due to its fiduciary regulations favoured by corporations and the fragmented banking sector. Consumers are increasingly seeking advisors who offer comprehensive, one-stop financial services, which is limited in the Canadian market. This shift has driven significant industry consolidation, catalyzing IGM to grow its U.S. business. The potential for growth in the U.S. market is significant, offering a hopeful outlook for IGM Financial's future.

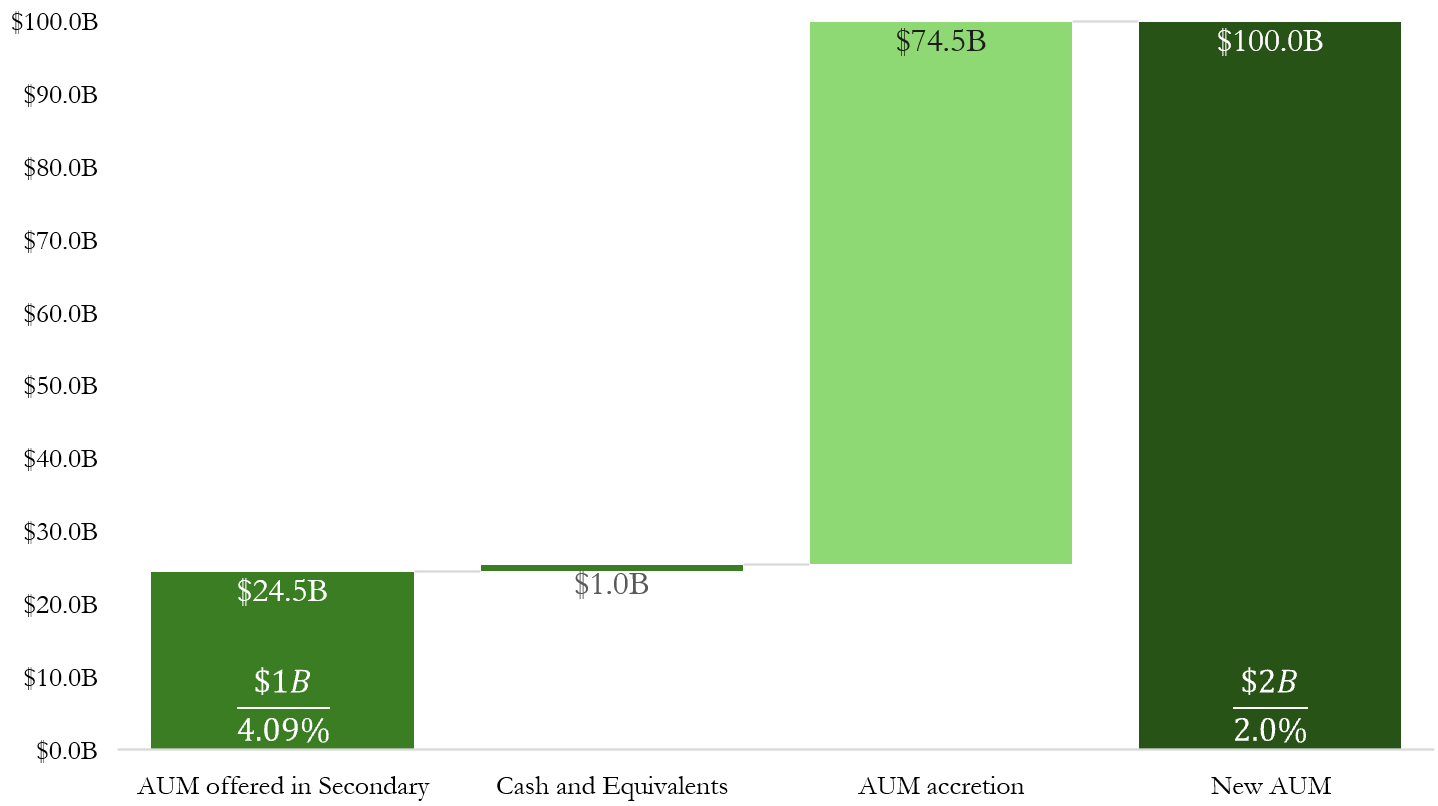

Wealth management firms in the U.S. are typically valued at 2 percent of their AUM in acquisitions. With the ~ $1 billion in Cash and equivalents on IGM’s balance sheet, the company could acquire roughly $50 billion in AUM. However, a $100 billion target is more reasonable to establish a meaningful competitive presence, considering CI Financial's U.S. wealth management operation held $161.4 billion in AUM as of March 2024.

IGM has two options to fund this expansion: A dilutive secondary offering to bolster the balance sheet or stock-based acquisitions. Currently, IGM is valued at a significant premium (4.09 percent of AUM) over its privately held targets (typically valued at 2 percent of AUM), providing many options for accretive share-based acquisitions. However, this window of opportunity is time-sensitive. As IGM’s market position shifts and investor sentiment fluctuates, its valuation multiple could decline. Given this, IGM should proceed with a dilutive secondary offering while its premium holds to raise funds with the premium and create flexibility for future M&A.

Buying Growth at a Discount: The Art of AUM Accretion

Similar to merger model accretion, AUM accretion evaluates the cost of acquiring new AUM relative to funding sources. IGM’s current 4.09 percent AUM to Equity ratio, meaning for every $1 billion in market capitalization, the company represents roughly $24.5 billion in AUM. By raising $2 billion through a secondary offering, IGM increases its market cap but can use that capital to acquire ~$100 billion in AUM at a lower multiple. Since U.S. firms are valued at ~2% of AUM, this capital allows IGM to acquire at nearly half the cost of its valuation—resulting in $74.5 billion in net accretion to its managed assets.

The key benefit of this strategy lies in valuation arbitrage - IGM is issuing stock at a higher valuation multiple than the assets it is acquiring. If IGM’s stock is valued at 4.09% of AUM and acquires firms at 2% of AUM, it effectively doubles the AUM per dollar spent, making the transaction accretive in total managed assets. Therefore, this accretion strategy is most effective while IGM’s valuation remains elevated. While dilution is a natural outcome of the secondary offering, the influx of new AUM will help offset it by expanding its revenue-generating assets.

IGM’s U.S. Power Play

The timing of this strategy capitalizes on significant market tailwinds, given that the RIA industry is experiencing a wave of aging partners in need of succession plans, creating a surplus of wealth management firms ripe for acquisition. By pursuing an inorganic growth strategy, IGM can effectively leverage the capital from a secondary offering to expand into the highly fragmented and rapidly growing U.S. wealth management market. This approach allows IGM to address the limitations of the Canadian market by entering a landscape with lower barriers to entry, active consolidation, and significant M&A opportunities. This expansion provides access to a more dynamic market and solidifies IGM’s position as a leading global wealth management industry player.