Michael Kors: Building a Future in Accessible Luxury

By: Zoe Trottier & Titi Ilori

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

From Shorts to Capri

Capri Holdings Ltd (Capri) is an American-based luxury fashion group founded in 1981 by American fashion designer Michael Kors. The group started as the Michael Kors brand and changed its strategic direction from a single brand operator to Capri, a European-style luxury conglomerate in 2017. The company undertook a series of acquisitions, acquiring Versace and Jimmy Choo, with the goal of reaching $8 billion in sales. Combined, the three brands generated $4.06 billion in revenue during fiscal year 2021 with a $62 million net loss. The Michael Kors brand offers two lines of products at differing price points: MICHAEL Michael Kors (MICHAEL), the accessible line, and Michael Kors Collection, the premium line. MICHAEL, its accessible line, represents Capri’s greatest source of revenue, at 36 percent of sales in 2021.

Out-Of-Style and In Denial

MICHAEL competes in the accessible, lower-price fashion segment alongside brands Kate Spade and Coach from rival American conglomerate Tapestry, as well as LVMH’s The Marc Jacobs. Michael Kors Collection, the premium line, competes with other premium luxury brands including Burberry and high-end LVMH fashion houses such as Celine, Fendi and Kenzo.

Competitors such as Coach and Marc Jacobs have seen tremendous growth in the past fiscal year, with Coach’s sales growing by 20 percent. Yet, despite an industry-wide recovery since the COVID-19 pandemic, Michael Kors has seen declining performance. Since 2016, revenues for the Michael Kors brand have decreased 9.1 percent annually from $4.7 billion to $4.0 billion in 2021, compared to annual industry growth of approximately one percent during the same period. This is particularly concerning given that the Michael Kors brand comprises 75 percent of Capri’s revenues and almost 100 percent of the group’s profits. Part of this decline can be attributed to the dilutive effects of the company’s accessible MICHAEL line to the premium Michael Kors Collection. While accessible and premium lines can coexist under the same brand name, as demonstrated by Ralph Lauren, brands must clearly differentiate between the two in order to preserve the premium line’s brand equity. For Michael Kors, the separation between the accessible and premium lines are unclear: on the brand’s website, the premium Michael Kors Collection is buried between lower-priced MICHAEL items, and frequent discounts further erode Michael Kors Collection’s premium brand image.

Coach Steams Ahead

The luxury personal goods industry, including apparel, accessories, jewellery and watches, is valued at $311 billion in 2020 and is expected to grow 12 percent annually to reach $434 billion by 2025. The use of data analytics to accurately predict consumer preferences has become a necessary tool for most brands to remain competitive, and has shown to be effective in turning around declining brands. An example of a successful turnaround is Coach: despite exhibiting similar levels of decline as Michael Kors in the mid-2010s, Coach was able to execute a successful data analytics strategy. The success from this shift is still evident today: unlike Michael Kors, Coach saw increased revenue over the pandemic, with revenues up 15 percent from the same period in 2019 and 27 percent from 2020 levels. Coach works with customer data platform Amperity to generate comprehensive customer profiles. Using these profiles, the brand is able to determine product and marketing characteristics that result in over-performing and under-performing product lines. This allows it to accurately predict consumer preferences in the upcoming season, and change its product offerings and marketing tactics accordingly. The early adoption of data analytics combined with a large data set allows Coach to react quickly and accurately to emerging trends, and has been successful in increasing Coach’s customer retention and reactivating lapsed customers.

In addition to its increased use of analytics, another revenue driver for Coach during the pandemic was the launch of their online outlet store coachoutlet.com. The purpose of the website is to remove heavy discounting from their main website and house exclusive accessible product lines while maintaining the brand’s premium perception on its primary online platform. From the launch in April 2020 to August of the same year, the outlet store generated 600,000 new customers, 50 percent of which were Gen Z, a demographic that is expected to become the largest luxury consumer group by 2035.

The Mean, Median, and a New Mode

While valuable, it can be extremely slow and difficult to acquire customers to generate more customer data. Coach’s powerful data-driven platform is enabled by its reach and scale — simply by virtue of having a larger sale, it is able to build a larger and more comprehensive database. Comparatively, Michael Kors is at a significant disadvantage. While Coach boasts over 120 million customer profiles, estimates place the size of Michael Kors’ database at approximately 47.6 million profiles, one-third the size of Coach. Clearly, it is unfeasible for Michael Kors to organically triple their database within a short time span, and if the brand is to reverse their decline, they must implement a robust data platform quickly. Hence, Capri must grow their customer database through an acquisition.

Shopping for an E-Boutique

Founded in 2006, Mytheresa is a German luxury multi-brand e-commerce company that hosts over 200 designer brands. In January 2021, Mytheresa went public and raised $406.8 million from their IPO. The debut coincided with an e-commerce boom driven by heightened COVID-19 restrictions, resulting in a 19 percent increase in share price at market close. In the last twelve months, the company grew both the number of orders shipped and active customer base by 35 percent to 1.58 million and 705,000 respectively. In the first quarter of 2022, Mytheresa had a net loss of $8 million compared to a net income of $10.6 million for the same quarter in 2021. This loss, however, can be attributed to a one-time increase in stock-based compensation from the 2021 IPO and should not affect future profitability.

As Mytheresa’s brand partners own inventory until it is sold on on the company’s website, the retailer is able to reduce its exposure to losses on items that underperform while saving on the cost of inventory. This strategy differentiates Mytheresa from competitors such as The RealReal, Farfetch, and Yoox Net-a-Porter, which has led Mytheresa to consistently outperform these competitors.

Data In a New Dress

To address Capri’s core problems, the company needs to expand its access to consumer data and create clearer separations between their premium and accessible collections. To do so, Capri should acquire Mytheresa to realize data and operational synergies, use the acquisition to create a Michael Kors capsule collection that differentiates between the brand’s accessible and premium lines, and establish an online outlet store to host the MICHAEL line separately from Michael Kors Collection.

As seen with Coach, market data can be incredibly valuable to stay ahead of trends and react quickly to changing preferences. By acquiring Mytheresa, Michael Kors would have access to an increase in customer data, which would include popular styles and products that Michael Kors may not currently offer. This allows Michael Kors to follow fashion trends based on a broader range of potential textures, colours, shapes, and other design elements, to ultimately make more accurate predictions for successful designs.

Not only does the data from the acquisition help with product innovation, but it also can improve customer experience. By identifying consumer preferences and habits beyond those of Michael Kors’ existing customer base, the fashion house can improve their interactions with customers; from release dates to promotions to product photos, Michael Kors can determine from other brands’ experiences what works best. Furthermore, Michael Kors can increase their degree of personalization, such as customized product displays based on previous purchases or clicks. Improved customer experience through tailored interactions and personalization can improve conversion rates and return customer rates as it creates a more convenient and enjoyable shopping experience.

Bringing E-Commerce to the Show

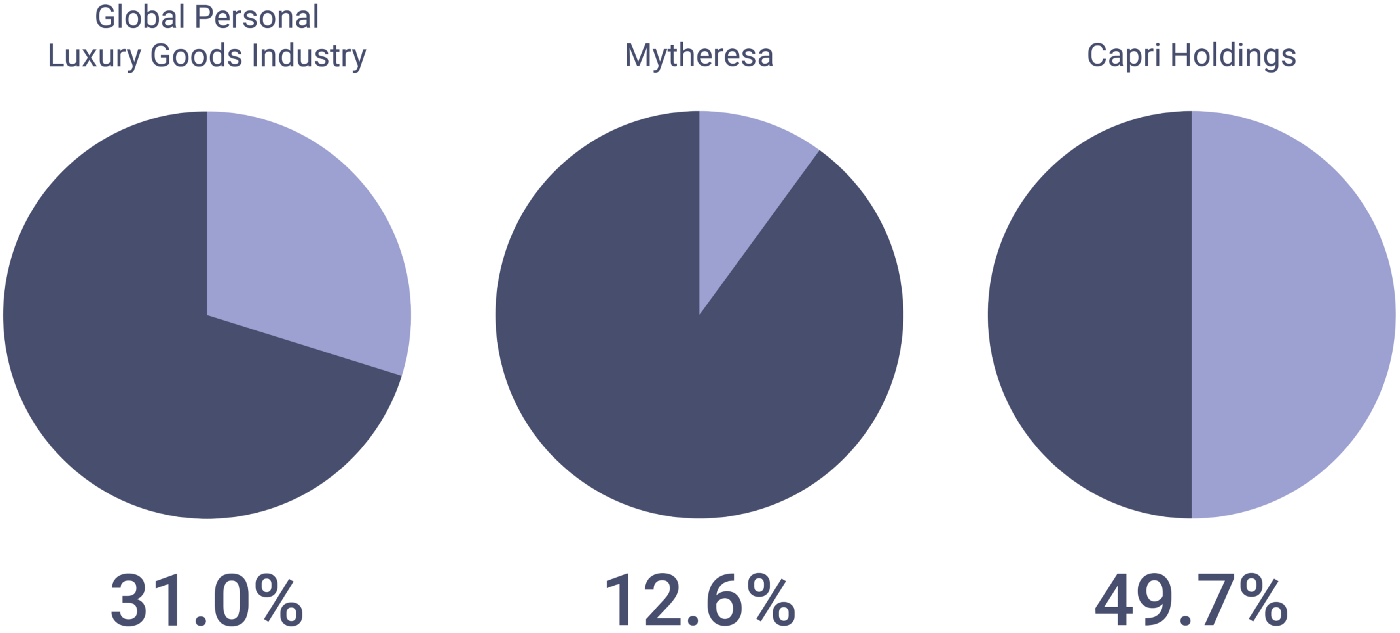

Outside of data advantages, the Mytheresa acquisition provides operational synergies to both parties. Capri’s strong North American presence can help Mytheresa with their U.S. expansion while Mytheresa’s expertise in e-commerce can help Capri reach their goal of doubling to tripling e-commerce revenues. Currently, Mytheresa is heavily dependent on European sales, with 18.8 percent and 41.1 percent of revenues generated in Germany and other European nations, respectively. Globally, the Americas, dominated by the United States, comprises 31 percent of personal luxury goods spending, making the country the largest national luxury market in the world. With only 12.6 percent of revenues generated within the United States, Mytheresa is currently missing a significant market opportunity. Given that 49.7 percent of Capri’s revenues are generated in the United States, this acquisition could help Mytheresa build the brand equity needed to grow its presence within the United States.

Mytheresa’s decade-long experience servicing luxury brands with e-commerce can help Capri achieve its goal of expanding its e-commerce revenues by two to three times. Mytheresa’s experience building customer loyalty without an in-store presence, an issue luxury retailers often struggle with when transitioning to e-commerce, can help Capri bolster online retention. Additionally, Mytheresa is led by the former vice president of Europe and Asia at eBay, Michael Kliger. His experience can help Capri increase their e-commerce presence in both Europe and Asia where Capri brands are less established.

Mytheresa also offers Capri the scale to efficiently deliver products to e-commerce customers quickly. Mytheresa’s logistic capabilities are robust enough to handle a high volume of international orders with approximately 40 percent of orders coming from outside Europe. Moreover, the average shipping time to non-European buyers is less than 72 hours. Post acquisition, Capri can improve its international order fulfillment using Mytheresa’s channels without reducing the shipping efficiency to domestic buyers.

Separation of Interests

As the Michael Kors Collection is currently plagued by the discount store reputation of MICHAEL, Capri must sever the connection between Michael Kors’ premium and accessible lines in order to rebuild demand for the accessible line without reducing the appeal of the premium line. To rebuild Michael Kors Collection’s reputation as a premium luxury brand, post-acquisition, Capri should host the Michael Kors Collection exclusively on Mytheresa and on michaelkors.com, and create a separate online outlet store for the accessible MICHAEL line. This benefits the brand in two ways. First, given the strong customer loyalty Mytheresa has built with high-end luxury buyers, hosting the premium Michael Kors Collection on the platform would help consumers associate the line with other ultra-premium brands, thereby rebuilding its brand equity. Secondly, by separating the accessible and premium lines, Michael Kors can improve its data quality, and thereby create more focused marketing campaigns to consumers of each respective segment.

Preparing for Takeoff

Michael Kors is no longer synonymous with the jet-set luxury aesthetic it pioneered decades ago. Creating a clearer division between its brands through an online outlet store and reacting more effectively to emerging trends through data analytics from a Mytheresa acquisition can propel the brand back into first-class.