Refining’s Renaissance

By: Oliver Robbins & Chad Gray

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

North American crude oil markets are in a state of flux. The advent of new oil drilling techniques, has unlocked enormous quantities of crude oil previously thought unrecoverable. US crude oil production is expected to grow 60% from pre-recession levels by 2017. This has led industry commentators to project that the US will be able to produce enough crude oil to meet domestic demand by 2030, something that hasn’t occurred within the last 40 years. This astronomical growth in supply has overwhelmed traditional pipeline infrastructure, leading to bottlenecks. The inability to connect oil production to market has caused a supply-demand imbalance, leading to depressed oil prices in certain regions. The North American benchmark oil price, West Texas Intermediate (WTI), has traded at a discount as large as $30 to world oil prices, which trade at around $110/ barrel (bbl).

Due to their location, refineries in the central US enjoy cheap domestic oil and the high margins associated with it. Meanwhile, refineries on the East and West Coasts are forced to buy oil from overseas at world prices due to pipeline bottlenecks. While refinery closures are nothing new, these recent trends have exacerbated the problem. Five refineries on the US East Coast have been forced to close since 2010, and three more were threatened with closure before they sold at extremely discounted prices. Similar problems face Imperial Oil’s Dartmouth, Nova Scotia refinery, which was put up for sale in May 2012 and will close if a buyer is not found. Management does not believe that the Dartmouth refinery is positioned to compete against the new, low cost refineries on the US Gulf Coast (USGC) and the refineries in the US Midwest, that have access to low cost oil. But major market changes are coming. Energy companies are spending billions of dollars to re-pipe the continent. Once all these pipelines are completed, the Dartmouth refinery will be competitively positioned relative to its peers.

Refining in North America

Crude oil is transported from the oil wells to refineries by pipeline, railcar, or tanker. Pipelines are the primary and safest method of transportation in North America. There are two types of oil, light and heavy crude, both of which refineries can process. Light oils are refined into gasoline, while heavier crudes produce diesel and jet fuel. Not all refineries can process both types of oil, reconfiguring a refinery to process light from heavy and vice-versa requires billions in capital investment and years to complete, making this option unattractive.

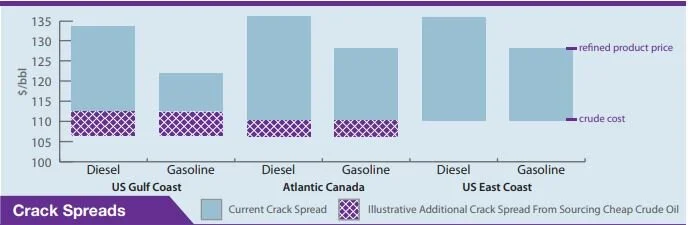

Refineries are expensive to build, have long payback periods (20-30 years) and sell low-margin products. They make their money off of the difference between the crude oil input costs and the refined product sales price. This is called the “crack spread”. Unfortunately, the prices for both commodities are very volatile and do not always move together. Additionally, refineries built outside North America are far more cost effective due to lower overhead costs, cheaper labor, and more lenient environmental regulations. These factors, along with stringent environmental and emissions legislation in the US make it clear why few new refineries have been built in the US since the late 1970s.

Changing Market Conditions

Dramatic increases in American and Canadian crude oil production is overwhelming refineries in the Midwest, creating significant oversupply. Pipelines moving crude oil out of the region to other markets are full, exacerbating the supply problem – leaving WTI oil discounted more than $20/bbl below world prices. A multitude of pipeline projects have been proposed to redirect oil surpluses to the USGC, the world’s largest refining center, to close this price difference. North American refineries located on the East Coast are amongst the oldest, most expensive to operate (twice as much as competitive refineries) and least sophisticated in North America, which allows them to only process light oil. These refineries only receive crude oil by tanker since there are no pipelines that connect. Building such pipelines would be prohibitively expensive. Reliance on high cost crude oil has forced several refineries to close or become idle as they are put up for sale. It took two last ditch sales to prevent 40% of the US East Coast’s refining capacity from being shut down in 2012. Shipping discounted Midwestern oil by railcar to these East Coast refineries has given them a new lease on life. However shipping by rail is much more expensive than by pipeline and is unsustainable in the long-run.

Southern Comfort: Crude Oil Economics in the Gulf Coast

Like Canada and the US Midwest, the USGC is also experiencinga surge of crude oil production. Current production in the region is expected to grow 50% from 3.7 million barrels per day (bpd) by 2017. Combine this with forecast deliver- i e s of 1.5 million bpd from the Midwest, and the USGC has effectively doubled its supply of North American oil, pushing out foreign oil imports. However, the incremental crude oil delivered to the USGC is lighter than the imported oil it used to process. New oil deliveries to the USGC will contain domestic light oil and heavy oil from Canada. Refineries in the USGC have spent billions over the past decade to convert their refineries to process heavy crude from Venezuela and Mexico. This means that refineries in the USGC will not be able to process the influx of light oil without significantly increasing their operating costs or spending billions to retrofit their refineries again. Reverting back to previous configurations would be a tough sell since these refineries have just recently completed their reconfigurations and to do it again would likely take another decade. Increases in USGC light oil supply is forecasted to completely push out light oil imports by the end of 2013. This will result in a massive oversupply in the Gulf Coast – the exact problem plaguing the US Midwest. Depressed prices will follow unless alternative markets are not found.

In the meantime, increasing supplies of domestic ultra-light oil, which contains more gasoline than diesel, represents a major dilemma for USGC refiners. This is because refining diesel is much more profitable than gasoline. Increasing crack spreads on diesel, have led USGC diesel production to grow dramatically. This new supply of light oil will leave refiners with two choices: 1) run the ultra-light oil, or 2) reject it and continue to run their existing crude blends.

Run American ultra-light oil

If the USGC refin- eries run American ultra-light oil, as opposed to the light oil they currently import, they will increase their gasoline production at the expense of their very profitable diesel business. Because refiners have little impact on the sale price of their refined products, the only way for these refineries to maintain profitability is to control their input costs. In effect, they will pay less for their raw material (light oil) to maintain margins. This will cause the price of light oil to decline (without needing a surplus of supply to exist) because the light oil that the refineries in the USGC are running is less valuable to them so they are willing to pay less. Short of a refinery reconfiguration, there is little available incremental capacity to process the surge in supply. Eventually the increases in oil supply will result in a surplus on the USGC, causing prices to decline.

Run existing crude blends

If refineries decide to reject the influx of ultra-light crude, an oversupply of ultra-light oil will result on the Gulf Coast immediately causing the price of crude oil there to decline. Either case will cause the price of light oil to decline by similar amounts over time, but these market forces will take time to act – at least until the majority of the Midwestern pipeline capacity is built by 2014.

Canadian Refining: More than it’s Cracked up to Be

Refinery capacities, throughputs, and prices of crude oil by region

Rail Strategy

In the meantime, Imperial Oil can take steps to lower its crude cost by replicating the crude by rail strategy which refiners on the US East Coast are using. Enbridge (one of the largest pipeline companies in North America) is aiming to reverse one of its pipelines to carry crude from the Midwest. This line will carry cheap Midwest oil to Montreal by early 2014. Oil could be taken off Enbridge’s pipeline at Montreal and shipped by rail to Dartmouth. By having Enbridge build a rail terminal at Montreal and utilizing existing rail lines at the Dartmouth refinery, Imperial Oil would only need to build an inexpensive off-loading terminal to receive the crude oil. Shipping oil by pipeline to Montreal and then on to Dartmouth by rail should cost roughly $9/bbl, half the cost of shipping oil all the way by rail. Though all of the pipeline’s capacity is spoken for, the savings on the cost of transportation would make it worthwhile for Imperial

Oil to inquire about an expansion. If prices on the USGC fail to fall quickly compared to world prices, a discount between Midwest and USGC crude will remain. This rail terminal can act as an insurance policy for Imperial Oil, ensuring access to cheap Midwest oil.

Refiners in Atlantic Canada will enjoy wider crack spreads than the USGC due to higher product sales prices

Imports from the US Gulf Coast by Sea

Once USGC light oil prices fall, Atlantic Canadian refineries such as the one in Dartmouth are well positioned to compete for supply of unrefined oil from the USGC. This is because their refining peers on the US East Coast cannot buy USGC light crude. Since there are no pipelines connecting the USGC to East Coast, the oil must be shipped by boat. This is difficult due to restrictions by a US regulation called the ‘Jones Act.’ The Jones Act requires all goods that are transported by boat between US ports be built and registered in the US, and owned and crewed by US citizens or permanent residents. The number and availability of Jones Act compliant vessels is limited, which makes shipping oil from the USGC to the US East Coast difficult and expensive. Although similar legislation prevents American crude oil from being exported, Canada is the only destination that has received exemptions. As long as the discount on the USGC is greater than the cost of transportation by tanker to the refinery ($2/bbl) then it makes sense to import American oil to Eastern Canada.

Imperial Oil should use its relationship with its parent company Exxon Mobil, a major refiner with significant knowledge and expertise in the USGC, to help source discounted crude. The less expensive crude will allow Imperial Oil to improve its crack spreads. By lowering its cost of crude in comparison with refineries on the East Coast, the Dartmouth refinery will no longer be the marginal cost refinery in Eastern North America.

As a consequence of Dartmouth’s lower crude input costs compared to its world competitors, the refinery would be well positioned to compete in international markets should they be unable to sell all of their refined products in Atlantic Canada.

Sale for a Price

Unless Imperial Oil wants to transition away from its refining operations, which is unlikely as they have made significant investments in their refining and retail operations in the past, they don’t need to sell this refinery. At a minimum, the input cost pressures Imperial has named as reasons for the sale are easily addressable with small capital investments. If Imperial Oil is particularly adamant about selling the Dartmouth refinery, it should make sure it sells at a significant premium to recent transactions on the US East Coast. These transactions occurred at valuations of $1,200-$2,000/bbl of daily refining capacity, which if applied to Dartmouth would imply a valuation of $105M-$176M.

Patience is Important

Less than five years ago, the US was faced with 20 years of declining crude oil production and rising imports. Refineries and pipelines were being oriented to accept and process these increasingly heavy and foreign crude supplies. Now, producers, pipeline companies, and refiners alike are asking themselves what they are going to do with all this excess domestic supply. The rise of hydraulic fracturing and its associated increases in production have created billions of dollars in investment opportunities, breathing new life into assets that were forecast to become relics of a domestic energy industry no longer; but this process takes time. Imperial Oil will stand to benefit from these changes to the oil market; they just need to be patient and make a few small capital investments to improve the profitability of their refinery in Dartmouth. It is Imperial Oil’s old thoughts about the economics of refining that need to become relics of the past, not its refinery.