BlackRock: Rocking the Boat of China’s Retirement Industry

By: Leo Li & Kenneth Wang

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

Black Rockin’ in the Free World

BlackRock is the world’s largest independent asset manager, with clients in more than 100 countries and roughly $9.5 trillion in assets under management (AUM). Central to the firm’s success is the core belief that technological innovation is essential to the delivery of high-quality asset management services. Through its investment management and risk advisory services, the firm has provided retirement solutions for millions of individuals and helped a multitude of institutional clients reduce portfolio risk through its Aladdin platform. Blackrock’s Aladdin is a particularly valuable asset because the platform is used for risk analytics and provides insight into investment processes for various products, including equity, fixed income, derivatives, and commodities, among others.

Despite being the world’s second-largest economy, China’s market has been elusive to foreign asset managers in the past few decades. Against the backdrop of reduced market regulation, BlackRock has hoped to establish a meaningful presence in China by helping Chinese consumers address their investment goals. In 2021, BlackRock became the first foreign firm to set up a wholly-owned subsidiary or joint venture in China’s mutual fund industry. However, its current partnership with a state-owned bank is unsustainable and limits the firm’s ability to capture market share.

Rocking Out to Liberalization

China’s pursuit of market liberalization began with economic reforms in the 1980s, which used curtailed government regulation and incentives to attract foreign investment. Since then, China has joined the World Trade Organization, causing foreign investment to grow significantly.

Despite these reforms, the country maintains a protectionist approach towards its financial sector, fearing the effects of economic instability on its premature capital markets. However, in recent years, Chinese policymakers have gradually begun opening the asset management industry to foreign players to curb its retirement savings deficit and bolster international use of the country’s currency. Currently, the pension shortfall is causing China to consider delaying the retirement age of its workers, which could incite problematic labour shortages in a population with an already declining birth rate.

Regulatory authorities helped facilitate a liberalized financial sector when they retired a 49 percent cap on equity ownership and encouraged local subsidiaries and foreign firms to reach retail investors with new mutual funds in 2020 directly. Capitalizing on these changes, BlackRock entered a wealth management joint venture with China Construction Bank (CCB) and Temasek, retaining 50 percent ownership. In September 2021, its maiden mutual fund raised $1.03 billion from more than 110,000 orders.

Capitalizing on Capital

With Chinese firms totalling $2.6 trillion in AUM in 2020, China became the wealthiest nation in the world in part due to an unprecedented amount of foreign and domestic capital flowing into the asset management industry. Despite an economic slowdown due to the COVID-19 pandemic, AUM is expected to grow at a CAGR of 10 percent through 2025; China’s demonstrated commitment to overhauling aspects of its financial system to lower geopolitical risk could help it outperform competing regions like the United States. On the domestic front, Chinese households have one of the highest savings rates globally, at 45 percent of GDP, compared to the world average of just 23 percent, creating a large pool of uninvested capital in the hands of Chinese retail investors. Thus, reduced barriers in China’s financial regulatory landscape have carved a unique opportunity for common retail investors to invest in higher-risk, higher-return products within the broader capital markets instead of simply contributing to their savings accounts.

Behind the Curtain

Despite growing demand, China’s asset management industry lacks the investment products investors require to achieve their financial goals. China’s asset management sector is currently dominated by wealth management products (WMPs), fixed-income assets from a portfolio of equities, bonds, and other financial instruments. Despite their popularity stemming from high yields, WMPs expose investors to high levels of risk because the industry lacks proper regulation. For example, one of China’s largest property developers, Evergrande, tested the Chinese real estate market when it tried to circumvent lending restrictions by issuing high-yield WMPs.

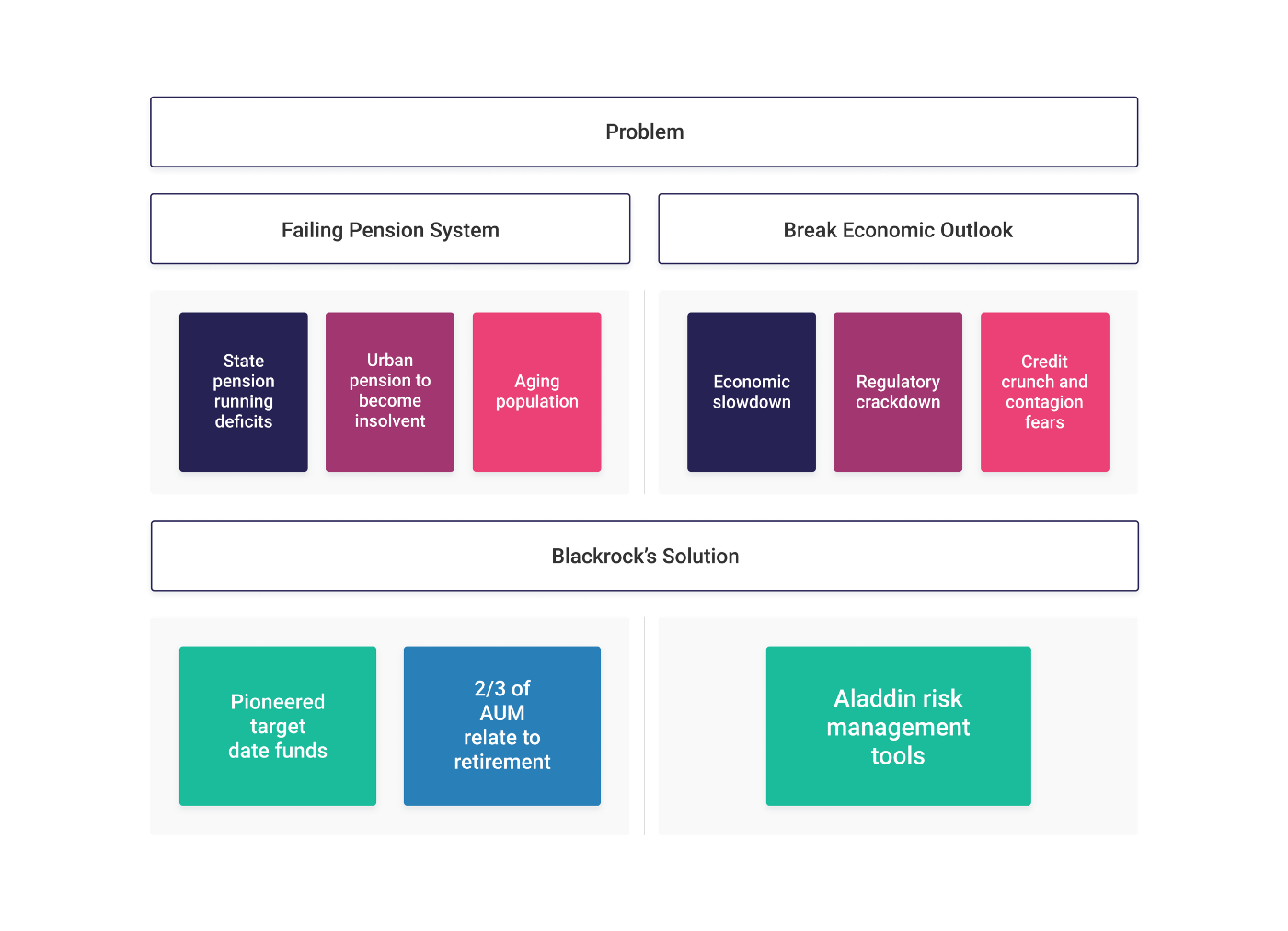

As China’s economic growth stagnates over time, it is increasingly evident that this high-risk economic model is not sustainable. Further, these practices also undermine the confidence and trust of consumers, deterring them from engaging with the asset management industry and resulting in a high savings rate. To address this, the China Banking and Insurance Regulatory Commission began imposing stricter rules on WMPs in 2018. This presents a challenge for BlackRock, as WMP reforms are expected to contribute to consumer confidence, increasing demand for WMP and incentivizing banks to develop their own WMPs. There are two problems that BlackRock can adequately solve and add value: the retirement crisis and increasing risk in the domestic market.

A Sinking Ship

China’s struggles with its pension system can largely be combated by BlackRock. The Chinese pension system is built on three tiers: mandatory government-led public pension funds (Tier 1), voluntary employment-based pension plans (Tier 2), and commercial pension products sold to individuals by fund managers (Tier 3). Currently, the population heavily relies on the first tier. However, due to an aging population (the number of people aged 60+ is expected to increase from 18 to 21 percent), cash outflows from pensions are in more significant volumes and at greater length, while cash inflows into the system are decreasing. Specifically, the state pension is running an annual deficit of $113 billion and the pension fund for urban workers is anticipated to become insolvent by 2035. As a result, China is encouraging personal retirement savings plans in Tier 3, growing from $400 billion to $3.8 trillion, representing a CAGR of 25 percent over ten years.

BlackRock can help China solve this problem by offering retirement products to consumers while also encouraging greater capital flow into the markets. By developing its technological abilities to create safe and reliable products, BlackRock has set an excellent track record with retirement solutions: approximately two-thirds of the assets that BlackRock manages relate to retirement. By providing a diversified mix of equities and fixed income, these funds can help Chinese investors take more risks when they are young and gradually reduce risk near retirement.

Rocky Waters

Following a year of regulatory crackdowns on companies and a credit crisis that risks spreading throughout the economy, China faces a volatile economic outlook. Realizing that much of the country’s growth has been fueled by unsustainable drivers such as real estate and debt, China has begun shifting its focus away from “quantity of growth” towards “quality of growth.” The government responded by imposing a series of sudden regulatory crackdowns on companies and industries viewed as hindering the country’s long-term economic goals. These reforms cause the domestic capital market to be highly volatile due to their timing, scope, and uncertainty.

Economic tensions are furthered by the recent credit crisis experienced by Evergrande, a dominant real-estate developer whose $305 billion debt is on the brink of default. As the economy faces an imminent slowdown, Chinese investors will need asset managers who can generate satisfactory returns while managing risks in a volatile market.

Compared to immature onshore asset managers, BlackRock has a clear advantage in the area of risk management. Since 2000, the firm has provided Aladdin to institutional clients, including asset managers, insurers, banks, and pensions. Therefore, the right distribution channel should allow BlackRock to distribute its products and alleviate investor concerns.

Shifting Gears

While BlackRock is positioned to solve many of China’s pending problems, its current partnership with the state-owned CCB is less than ideal. The CCB’s interest in the joint venture stems from the need to circumvent poor investor confidence in bank WMPs, by distributing products developed by Blackrock — a respected foreign firm in the eyes of investors. However, as existing asset management practices become overhauled by Chinese regulators, the CCB may be demotivated from participating in the joint venture due to the dilution caused by revenue sharing and a lack of operational control. Given the magnitude of the retirement crisis, state-owned banks have a mandate to increase the capital allocated into Tier 3 retirement. Therefore, the CCB could become a significant competitor to BlackRock in China by developing its own WMPs.

In BlackRock’s eyes, the current partnership leaves something to be desired. Given challenging political landscapes and a lack of onshore brand recognition, BlackRock must find a new distribution channel if it wishes to succeed in China. As Chinese consumers rapidly adopted mobile payments starting in the early 2010s, wealth applications have become the primary point of interaction with their finances. If BlackRock does not quickly move into the online distribution channel, it risks state-owned banks developing their own apps and establishing themselves as a dominant distributor.

The Old Guard Falls

Technology companies have increasingly utilized their platforms to offer financial services, and this trend is especially prevalent in China. Established players such as Tencent-owned WeChat and Ant Financial possess strong technological capabilities and brand recognition, which affords them a competitive advantage in the asset management industry. Compared to traditional banks with higher fixed-cost structures from owning physical locations, these companies pass those savings onto the consumer by offering products and services that are up to 10x less expensive. Additionally, synergies with moving money through existing platforms such as payments and wallets add value and convenience for the user. This is shown through a recent joint venture partnership between Vanguard and Ant Financial. In less than a year, more than 1 million users signed up for BangNiTou, a smartphone-based product offering robo-advisory services. The success of this strategy signifies a trend towards foreign asset managers bringing expertise and establishing trust through partnerships with domestic technology companies.

A New Dawn

Given the tailwind of the industry’s shift into financial technology, BlackRock should partner with WeChat to support the developments in their fund distribution unit (Teng An Fund) and play an advisory role to assist in the country’s retirement crisis. As a social media app with over 1.25 billion active users and representing more than 78 percent of China’s population, this partnership would offer Blackrock immediate access to billions of retail customers and accelerate the company’s market share capture in China.

WeChat is currently lagging behind Ant Financial in the fintech wealth management area, which means the firm could benefit from BlackRock’s retirement and risk expertise. Ant Financial’s Yu’e Bao (a wealth management app) has reached $165 billion in deposits and 520 million paying customers in China, becoming the world’s largest money market fund. By contrast, WeChat had only recently established its fund in August 2020.

With many problems lingering in the investment industry, BlackRock can provide Aladdin’s technology to assist the Teng An Fund, adding new innovative products and ensuring that existing mutual fund products are suitable for consumers while properly ensuring risk management. Given BlackRock’s history and track record of success, this will improve the credibility for WeChat to offer these funds, similar to Vanguard’s strategy. Furthermore, BlackRock could sell its current mutual funds through WeChat as a new distribution platform and attract investors faster. Ultimately, this will significantly improve BlackRock’s brand recognition in China and allow the company to aim for a larger share of China’s mutual fund sector.

BlackRock can help solve China’s retirement problem and improve investor returns in a volatile market. However, its current strategy is not sustainable because a lack of accessibility limits its market potential. By partnering with WeChat, BlackRock is one step closer to achieving its goal of becoming a dominant player in emerging markets.