Teck Resources: A Bold Pivot

By: Alison Xie

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

Navigating New Horizons

Teck Resources (Teck) stands as a leading diversified Canadian mining company, with a global footprint spanning Asia, Europe, South America, and North America. Renowned for its prowess in exploring, developing, and extracting natural resources, the company's forte historically lies in Steelmaking Coal, Copper, and Zinc. Notably, Q3 2023 financial reports reveal Steelmaking Coal as Teck’s primary revenue driver, contributing 57.5 percent year-to-date, with zinc and copper accounting for 21.6 percent and 20.9 percent, respectively. Teck's robust profit margins underscore its success, registering 43 percent in copper, 24 percent in zinc, and an impressive 60 percent in steelmaking coal. However, a strategic shift looms following Teck’s recent sale of its coal business to Glencore, prompting Teck to navigate a new strategic trajectory. With the sale of its legacy coal business, Teck is currently in strategic realignment. To remain one of the largest mining firms in Canada, Teck should use the proceeds from selling its steelmaking coal segment to establish a strong foothold and first-mover advantage in the critical minerals industry.

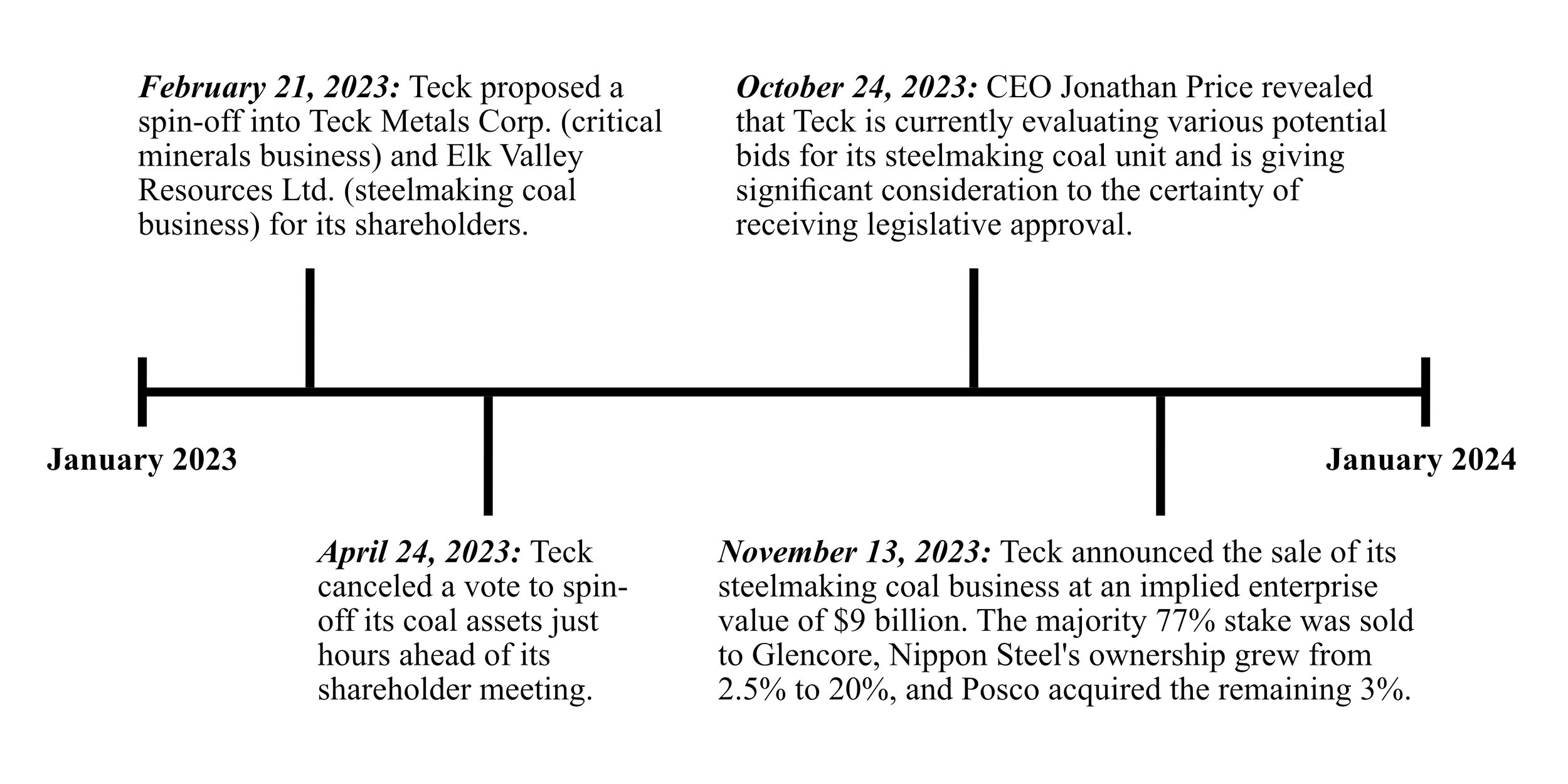

Here’s a brief timeline of Teck’s key events throughout the 2023 Fiscal Year:

Harmony of Change: Teck’s Theatrical Pivot

Teck put forward a series of compelling reasons underpinning the decision to sell its steelmaking coal segment. Firstly, the move is aimed at unlocking the inherent value embedded in its legacy steelmaking coal segment, capitalizing on the segment's exceptional margins, and seizing upon Glencore's attractive implied valuation of $9 billion for this division. Secondly, by streamlining the current Dual-Class share structure, Teck plans to enhance and optimize its overall capital framework. Teck has released a six-year sunset period, at the end of which, the Class A shares would be automatically converted into Class B shares simplifying Teck’s capital structure. Finally, the sale intends to strengthen Teck’s balance sheet through the optimization of leverage ratios and improved cash position.

However, Teck's decision to sell isn't solely rooted in the sale proceeds or optimizing its capital structure — though those are definite benefits. The primary driver behind Teck's sale is a strategic pivot toward the critical minerals industry. Teck's move into critical minerals aligns strategically with the booming demand driven by clean energy technologies like solar PV and batteries, catapulting the sector to remarkable growth. This shift positions Teck in a swiftly expanding market, an acute move that promises considerable potential. However, the true game-changer lies in the realm of valuation growth through reduced weighted average costs of capital. With investment banks increasingly drawn to ESG-focused deals and investors showing an appetite for critical minerals exposure, Teck stands to benefit from reduced costs of debt and equity increasing the value of their core business operations. After spinning out the legacy non-ESG coal business, Teck has the potential to command a higher valuation in the public markets. Currently, the company trades at a next-twelve-months EV/EBITDA ratio of approximately 5x, whereas large critical mineral-focused producers, such as copper, tend to trade within an average next-twelve-months EV/EBITDA range of 6-8x.

Teck's Overture in the Global Energy Transition

In the current era marked by an unprecedented energy transition, economies worldwide are making efforts toward sustainability, evident in ambitious initiatives such as President Biden's Inflation Reduction Act (IRA), which contributed a staggering $369 billion toward clean energy infrastructure. This marks the most significant clean-energy infrastructure investment in U.S. history. As nations continue to pursue their climate goals, the demand for critical minerals will continue to surge. This surge in demand underscores the urgency for Teck to capitalize on this evolving landscape and the importance of Teck’s role in escalating extraction to meet future demand.

Powering Ahead: Teck's Lithium Leap With Steel-Making Coal Proceeds

Amidst the rapid global uptake of electric vehicles, bolstered by promising sustainable transportation policies and substantial green energy investments like the IRA, Teck stands to capitalize most through a strategic entrance into lithium extraction. Lithium stands among the top six critical minerals as identified by the Canadian Critical Minerals Strategy, holding substantial significance alongside copper, graphite, nickel, and cobalt regarding their utility in clean energy infrastructure.

The electric vehicle (EV) industry, a key consumer of lithium, has seen an enormous rise, with Q3 2023 witnessing a staggering 49.8 percent surge in EV sales over Q2. Recognizable players like Volvo, Nissan, Mercedes, and Hyundai have experienced sales spikes of over 200%, underlining the sector's rapid expansion. Trends such as technological advancement, falling selling prices for EVs, and changing consumer preferences toward green energy alternatives exhibit continued sector expansion accounting for increasing global lithium demand.

Global policies promoting sustainable transportation, such as Europe's "Fit for 55" program and India's EV scheme, coupled with substantial green energy investments such as the US Inflation Reduction Act (IRA) of 2022, highlight the pivotal role lithium plays in fulfilling green initiatives. McKinsey's projections affirm this, envisioning a monumental surge in lithium demand, projecting a jump from 700 gigawatt-hours (GWh) in 2022 to a staggering 4,700 GWh by 2030. This demand, primarily from EV batteries, reflects an astonishing 27% annual growth rate, propelling the battery value chain to potentially reach $410 billion in annual revenue by 2030.

Teck, recognizing this trend, can strategically utilize proceeds from their steelmaking coal segment to enter into Lithium extraction. Their rapid ongoing expansion in demand for both EV batteries and battery energy storage exemplifies the potential for Teck to enter this rapidly growing market.

Charging Forward: The Case for Teck’s Investment in Argentinian Lithium

Teck should consider Argentina as the premier choice for lithium exploration. Argentina is home to the world's third-largest lithium reserve, totalling 2.7 million tonnes or 10.4 percent of the estimated global lithium supply. With lower extraction rates relative to its peers, less environmentally disruptive extraction, and recent favourable election results, Argentina emerges as the optimal option for Teck’s lithium endeavours.

Argentina, despite being the fourth-largest annual lithium producer, maintains the lowest production rate relative to its reserve size among the top four lithium-producing peers. This intriguing dynamic indicates significant untapped potential for expansion within the country. Considering Teck's expansion prospects, Argentina emerges as the most promising market for production growth. The country's vast lithium reserves, coupled with its comparatively underutilized production capacity, present a compelling opportunity. Expanding operations in Argentina holds the promise of unlocking substantial production growth, aligning with the rising global demand for lithium in the context of electric vehicles and renewable energy storage systems.

Argentina's lithium reserves are mainly found in salt flats or brine deposits and is a member of the South American "Lithium Triangle" alongside Bolivia and Chile. Extraction from brine deposits tends to be more cost-effective compared to hard-rock mining methods in other locations. However, the extraction process itself can vary in complexity and efficiency depending on the specific characteristics of the deposit. Recent advances in Direct Lithium Extraction technologies offer ESG advantages and are less dependent on weather conditions. These innovations also result in higher lithium recovery rates from brine. While they may entail slightly higher costs, a Goldman report indicates that this technology could be implemented between 2025-2030, aligning with Teck's investment timeline and favouring the prospect of entering the lithium triangle as opposed to peers such as Australia and China.

Argentina compares favourably to Chile and Bolivia within the Lithium Triangle. Bolivia's socio-political and technological challenges coupled with its landlocked geological location, and Chile's recent move to nationalize the lithium industry, make Argentina the most promising alternative. Unlike Chile, Argentina's decentralized approach to lithium rights and taxation, controlled by provincial governments, reduces the likelihood of nationalization and the formation of large state-owned mining companies. This is advantageous for Teck, a Canadian company and foreign investor, as it minimizes the risk of competition with state-owned entities and government interference.

While there is no current Free Trade Agreement (FTA) between the US and Argentina, officials believe that the existing Trade and Investment Framework Agreement (TIFA) aligns with the Inflation Reduction Act (IRA) requirements. Argentina also has a standing FTA with the European Union, providing market access. Ongoing EU-Mercosur negotiations could enhance project competitiveness for European markets, encouraging local refining and cathode production.

Argentina’s 2023 presidential election resulted in the election of far-right party candidate Javier Milei which represents a significant tailwind for the lithium industry. While Argentina has long struggled with hyperinflation, Milei’s proposed dollarization plan suggests Argentina may adopt the U.S. dollar, benefiting foreign investments by reducing inflation and exchange rate risk. This is a key factor favouring Argentina. Additionally, Milei strongly supports increasing lithium production likely resulting in an advantageous future business climate for firms entering Argentina. Lastly, Milei has expressed his geopolitical priority to the US and his stance on freezing ties with China, fostering a strong bond with Canada and the US. Moreover, his support of free trade and free-market policy further emphasizes the opportunity for Canadian and American upstream lithium producers.

Teck’s Bold Pivot

Through the investment of the Glencore sale proceeds, Teck has the opportunity to enter into upstream lithium production in Argentina. This move not only aligns with the global shift towards sustainable energy but also reinforces Teck's position as a prominent critical mineral producer. Through the strategic allocation of resources in lithium production, Teck is poised to capitalize on the rapidly growing lithium market, increasing its valuation through a reduction in its cost of capital and solidifying its commitment to shaping the future of sustainable resource development through the extraction of key critical minerals.