Amazon & Tesla: Driving in the Amazon of Competition

Amazon Drone Sites

If a shopper wanted to buy bacon flavoured toothpaste right now, they could simply search “bacon toothpaste” on Amazon, browse a wide assortment of selections, and click a button to order it. You would expect your bacon flavoured toothpaste to be flown across the country, processed through a warehouse, and delivered to your doorstep within a few days. This is e-commerce today; an industry with global sales of $1.9-trillion and annual growth of 23.7 per cent. Although Amazon is diversified into a range of industries, Internet retailing remains the core of its business, making up almost 70 per cent of Amazon’s $136-billion revenue in 2016.While leading the competitive landscape of e-commerce, Amazon has fundamentally changed the buying process of consumers. With the Amazon Prime program, customers receive free two-day shipping on eligible products, exclusive discounts, and access to a wide variety of Amazon services for $99 a year. In fact, Amazon’s e-commerce strategy heavily relies on the growth of its Prime program; in 2016, the company added 20 million members on top of the 46 million base. Data has shown that Prime customers are not only more loyal to the platform, but also spend 2.4 times more than their non-Prime counterparts. However, the value proposition of fast, inexpensive, and convenient service to Prime clients requires constant innovation on the part of Amazon to stay ahead of the fierce competition.

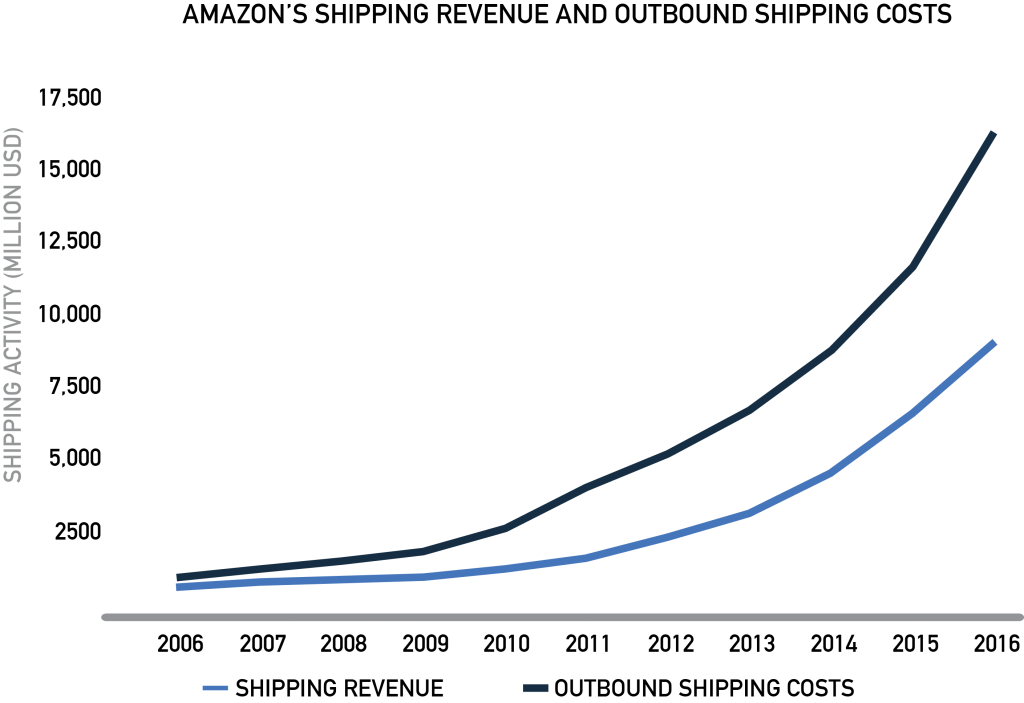

In 2016, Amazon reported $16.2-billion in shipping costs but only $9.0-billion in shipping revenues collected from Prime customers, with growth rates of 40 per cent and 37 per cent respectively. These shipping costs represent a staggering 17 per cent of Amazon’s e-commerce revenue and consisted of fees paid to third party services including FedEx, and UPS. For the millions of products eligible for free shipping to Prime members, there is a fixed shipping revenue of only $99 per customer which implies that the incremental cost of shipping each individual package is transferred to Amazon. The misalignment in Prime revenue and cost structure necessitates Amazon to decrease the cost it pays for delivery if it is to continue aggressively growing its Prime membership base.

Competition Moving into the Amazon

Amazon’s current business model is lucrative despite low margins due to high volumes; every year, Amazon sells several billion products with an average margin of approximately 1.5 per cent. For logistics companies, the shipping costs that Amazon pays presents a highly attractive opportunity. Amazon’s shipping partners have guaranteed revenues on billions of annual shipments. Instead of losing a large portion of revenues to third parties, Amazon should enter the shipping business itself.

Amazon currently operates a complex global system in which sellers ship products to one of the company’s 189 worldwide fulfillment centres, which are warehouses that use algorithms to sort and store products. The packages are ultimately shipped by partners such as UPS and FedEx, who deliver the product to the customers’ doorsteps. Although third party logistics companies currently operate as distribution partners, Amazon will always forfeit some control and margin to these partners. Furthermore, surprising competitors from unexpected industries are emerging as e-commerce grows. In 2015, Uber purchased Otto, a San Francisco startup that develops self-driving truck technology and made its first automated delivery in late 2016. Originally disrupting the taxi industry, Uber is expanding into adjacent transportation segments to do the same. Also entering the race is Alphabet, who filed patents in 2017 suggesting the behemoth tech company is also moving into the delivery industry with self-driving trucks. Competition is gaining on Amazon with Alphabet and Uber battling over stolen driverless technology.

With leading players expected to devise their own defensive strategies to remain competitive in the shipping business, competition within Amazon’s domain is growing. Amazon’s key to creating loyal customers is its Prime program, an implementation that thrives on significantly reducing costs for consumers. However, it cannot sustainably continue this aggressive growth strategy without first rationalizing its shipping cost structure. Analysis shows that the logistics industry is now ripe for Amazon to enter and reclaim its shipping fees by partnering with the largest in self-driving electric vehicles, Tesla Motors. In a deal to develop and own an autonomous electric fleet, Amazon would save on two major variable cost drivers of shipping, labour and fuel. Amazon must act now to protect its margins and leverage a position that no shipping nor technology company has: the world leader in Internet retailing.

First Attempts

In an effort to reduce costs and provide quick delivery, Amazon has made attempts at developing its own shipping solutions. In addition, Amazon found that nearly 80 per cent of U.S. Prime members signed up for service because of free two-day shipping. Developing an in-house logistics system would better allow Amazon to improve access to this service that is generating loyal customers. The Global Supply Chain by Amazon is Amazon’s internal distribution system, in which the company has invested in the aggressive construction of fulfillment centres, and numerous purchases of trucks, aircraft, and ships. Even Amazon’s high-profile air drone technology is getting more investments in an attempt to cut delivery cost in the long-term. Although these proactive attempts are commendable, they are simply not enough to alleviate Amazon’s cost pressures in labour and fuel. If Amazon cannot perform in-house delivery at a lower variable cost, they will be unable to cut third parties out of the delivery process.

The Tesla Opportunity

In 2016, Elon Musk released the plans for Tesla’s next ten years in his “Master Plan, Part Deux.” It announced Tesla’s plan to develop self-driving electric semi-trucks, coined the Tesla Semi. Traditionally a luxury car manufacturer, the new Tesla Semi will be produced for mass use, as its main value proposition is to reduce the carbon footprint of the trucking industry. As one of the leading industry players with both electric and self-driving technology, Tesla presents a perfect opportunity for Amazon to cut costs, and consolidate its distribution network.

With the highly anticipated launch of the Model 3, its mass market electric car, Tesla is expecting to spend between $2 and $2.5-billion in capital expenditures by mid-2017. However, negative annual free cash flows that fluctuate around $1-billion indicate that financing may be an issue for Tesla. This financing gap is compounded by additional projects, including the Tesla Semi, which still require investment for its development. With competitors such as Daimler scheduling production of its own electric truck for 2020, it would be wise for Tesla to accelerate development of the Tesla Semi. Given the current resource constraints, analysts worry that Tesla will burn through their cash before they can realize returns on their projects. Development of the Model 3 is a hurdle Tesla must overcome before it can focus on the Tesla Semi. However, the scale of Amazon’s distribution network will offer Tesla a massive data log that will be instrumental in furthering their electric and autonomous technologies.

In 2016, Amazon’s $9.7-billion in free cash flows would keep Tesla afloat. Tesla would receive cash to help fund research and production of its first fleet of trucks, and provide a pre-payment for its first order. In exchange, Amazon, would get exclusive access to the first Tesla Semis produced. With Tesla’s battery range of over 420-kilometers, the truck fleets would first work alongside the current system, but eventually replace gasoline trucks and third-party shipping services.

Delivery costs are largely comprised of fuel costs and compensation, representing 5 per cent and 60 per cent of total operating expenses, respectively. Implementing self-driving electric trucks would remove both these costs from the equation. After full implementation, the truck fleet would bring $1.1-billion in annual cost savings, representing a 7.5 per cent reduction in operating expenses. By bringing the logistics network in-house, Amazon also regains control over shipping and handling, enabling the retailer to track its packages and better meet customers’ demands for quick service. This partnership would build Tesla’s capability for semi-truck production and provide groundwork for a long-term relationship with Amazon.

Anticipating Pushbacks

As with any new technology, regulatory pushback is expected since self-driving trucks would take humans mostly out of the equation. Long-haul truck driving employs approximately three million people in America, however, the industry has already been experiencing a driver shortage and projected to be short 240,000 drivers by 2022. Furthermore, with over 400,000 trucking accidents that kill nearly 4,000 people per year, are mainly caused by human error, taking humans out of the equation has indisputable benefits. As of 2017, nine states in the US have opened roads to the testing of autonomous vehicles. As large companies like Uber and Alphabet push for regulatory change, it will only be a matter of time until other states follow suit.

Tying it All Together

Implementing an electric self-driving truck fleet also has substantial long-term cost saving opportunities. When Amazon made headlines for its development of drone delivery through Amazon Air, many people were confused. What was the justification for such a massive investment into a seemingly “gimmicky” product? The rationale is explained by the infamous last mile problem. Delivery companies incur anywhere between 30 to 50 per cent of the entire trip cost within the last mile of the delivery because they must enter neighbourhoods and individually drive up to each doorstep. The last mile is where key cost drivers of labour and gas are spent.

Amazon Air seeks to launch drones to solve the last mile problem, but is faced with one major technical constraint: limited battery lives. Since the drones must be deployed from a central Amazon facility, their reach is severely confined. By implementing self-driving Tesla trucks, Amazon could create mobile warehouses from which drones could be deployed, allowing the delivery systems to reach Amazon’s suburban and rural customers. The intersection of the two technologies would allow Amazon to harvest 30 to 50 per cent in cost savings.

If Amazon can successfully implement and integrate self-driving trucks with drone delivery, the online retailer could become a formidable force in the shipping industry. With competitive drone technology and self-driving vehicles, Amazon could potentially replace its partners and offer delivery services to other retailers. With an estimated $400 billion in global revenues, the shipping industry is lucrative and ripe for entering with the correct disruptive technology.

Amazon has already satisfied two important factors required to succeed in e-commerce; a strong first mover’s advantage and a growing number of loyal users. To combat the threat of incoming competition and prevent margin erosion, Amazon should invest in a cost-cutting fleet of electric, self-driving cars produced by Tesla. In addition to providing a lower cost alternative to traditional shipping, this backward integration will enable Amazon to spearhead innovation within the logistics and transportation industry. Together with drone technology, Amazon will be enabled to capitalize on the burgeoning autonomous technology segment, outpace competitors, and most importantly, self-drive into a more lucrative future.