Diamonds In the Rough

By: Arth Patel & Allan Yan

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

While it is hard to imagine, the coal industry was booming in 2008. Thermal coal, which is used for power generation, peaked at $140 USD per ton. Since then, the industry has fallen from grace, with larger share price declines than the tech industry saw in the early 2000s, or the financial sector saw in the Great Recession. Today, thermal coal prices trade at $42 USD per ton, and if prices remain this low, most coal companies will need to take drastic measures to preserve liquidity. Many miners took on heavy debt loads in the commodity boom of the late 2000s to finance capital investment and aggressive M&A activities. However, the new price paradigm does not support coal miners’ leveraged capital structures, which has resulted in a wave of bankruptcies across the industry. Amidst the bloodbath, there exists an opportunity for unconventional players to profit from providing desperately needed capital to struggling coal miners.

Demand for US coal has been falling since 2008, driven by the retirement of aging coal-fired plants due to burdensome regulations and low natural gas prices. Since 2007, coal’s share of power generation in the US declined from 48.5% to 39%. Despite low coal prices, environmental regulations make building new coal-fired power plants or retrofitting existing plants in America uneconomical. While coal will remain a significant fuel source for US power generators for the foreseeable future, it will experience a slow and steady decline as it is replaced by natural gas and renewable generation.

These low prices and flagging demand has caused many of the largest miners to declare bankruptcy. As debt maturities loom, miners are scrambling for cash as lenders are no longer interested in lending to a bad credit. Compounding the liquidity problem are other massive liabilities such as asset retirement obligations (mine closure and environmental reclamation), which require cash or liquidity to pay. Some miners in weak financial positions may be required by government regulators to put up additional capital in the form of self-reclamation bonds to cover their environmental liabilities. For example, Alpha Natural Resources was required to put up $411M USD in collateral just to continue operations in Wyoming. Despite the turmoil in the industry, coal production has remained relatively flat. The reluctance of coal miners to substantially cut production has kept the market oversupplied, and a rebound in prices is unlikely in the face of declining demand. Given the bleak commodity fundamentals, limited access to capital markets, and few remaining easy cost- cutting measures, companies need to creatively find ways to strengthen their balance sheets. One place to look is in one of their biggest customers – the US power sector.

Power in the USA

The US power system is composed of 3 parts: power generation, transmission, and local distribution. Amongst power generators there are two main types – regulated utilities and independent power producers (IPPs). A majority of US electricity generation is regulated, where consumers pay an adjusted rate ‘guaranteeing’ a fair return on equity invested by the generator. IPPs are private generators which generate and sell electric power in a free market environment. Unlike in regulated markets where utilities have a predetermined rate of return, generators in deregulated markets are not limited in the returns they can generate. As coal prices fall and miners commiserate, coal-fired power plants have benefitted greatly from meaningful input cost reductions. Furthermore, power generators have typically had healthy dividend yields and strong cash flow generation, making them an attractive income investment in today’s low interest rate environment.

In deregulated power markets, IPPs are competing aggressively with each other solely on price, signifying that IPPs will have difficulty growing revenue. IPPs are forced to turn to cost- cutting measures to grow profitability, due to single digit profit margins. As such, even small cost savings can have a big impact on profitability.

A Sparkling Investment Opportunity

Companies with coal-fired power plants can look to partner with distressed or bankrupt coal companies like Alpha Resources by providing liquidity upfront in exchange for a long-term discounted coal price. This is a common financing mechanism called a streaming agreement which is used in other kinds of mining. In a streaming agreement, a miner is given capital by a streaming company in exchange for the right to purchase what is produced at a set price over a certain period of time. Typically, the streaming company would then sell what they purchase at the spot rate, pocketing the difference. This model has been proven to work across the mining sector. For instance, Silver Wheaton has streaming deals with 29 mines and has a market capitalization of $7B CAD.

American Electric Power (AEP) is among the largest generators of electricity in the US, with a $28B USD market capitalization and annual revenue of $17B USD in 2014. Their two largest coal-fired generating facilities are in Ohio, near the large Appalachian coal basin, and consume a combined 10M tons of coal annually. Because coal is a low energy density fuel, power plants require a lot of coal to generate electricity. As a result, coal transportation costs from mine to the power plant are significant for coal-fired generators, and in some cases may even represent the majority of the landed cost of coal. Facilities with low existing transportation cost would benefit most from a streaming agreement.

Alpha Natural Resources is one of the largest coal mining companies in North America by production, mining 84M tons in 2014 and has thermal coal mines near AEP’s coal power plants. In 2015, Alpha’s stock fell 98.8% and has subsequently entered Chapter 11 reorganization. This reorganization provides AEP with the opportunity to negotiate a streaming arrangement with a motivated counterparty, Alpha’s creditors.

The Power Play

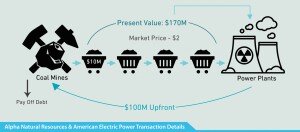

AEP would deliver upfront liquidity of $100M USD, in exchange for the right to purchase 10M tons of coal per year at a $2 USD per ton discount to the market rate for a 15-year term. AEP will stream coal from Alpha’s Eastern coal operations to its two largest facilities in Ohio, the Gavin & Cardinal facilities. Alpha produces roughly 29M tons of coal per year and these two facilities are a creditworthy guaranteed market for a third of Alpha’s eastern coal production. According to industry data, AEP spent over $550M USD on coal for these two plants in 2014 - therefore any cost savings per ton would create substantial savings.

Due to its bankruptcy proceedings, the company has an opportunity to renegotiate debt obligations, unfavorable contracts, employee expenses and other costs, allowing the firm to become more profitable. Therefore, Alpha has room to maneuver on pricing moving forward. Alpha’s current EBITDA/ ton on Eastern thermal coal sales is roughly $6 USD, which can still be maintained if cost cutting measures are implemented elsewhere in the company. If AEP can capture a fuel savings of $2 to 3 USD per ton, they could save $22M USD to $33M USD annually. The $100M USD purchase price would yield an IRR of 15% to 20%, comparable to other streaming deals.

Alpha can use this $100M USD liquidity injection to pay off its secured debt obligations, or to keep on hand. Having cash on hand would lower bankruptcy costs, provide the ability to refinance debt at lower rates (due to lower perceived risk), and remove the need to put up capital in the form of reclamation bonds. These are all potential benefits to Alpha and its creditors by completing a streaming deal with AEP.

While streaming agreements work with both fixed and variable pricing structures, a $2 USD per ton discount to an index would allow streaming coal generators to maintain a cost advantage against other coal generators should prices decline, and would allow coal miners to be exposed to any increases in coal prices.

As a result of dramatic declines in coal prices, miners are left in a difficult position. Many companies would benefit from an injection of liquidity, but accessing debt or equity markets would be at punitive valuations if at all feasible. A streaming agreement would be a much more palatable fund raising alternative for many coal miners and would provide coal- fired power generators a long-term cost advantage over their competition. Moreover, given that most of the US power market is regulated, this strategy may have significant potential outside of unregulated markets. After assessing the benefits of such transactions, regulated utilities can look to implement this strategy in regulated markets, working with regulators to determine fair allocations of the additional value from the transaction between the utility and ratepayer.

While regulated utilities scratch their head on how to execute this transaction, IPPs will have first cut mining through the coal looking for diamonds in the rough.