Disney: Bringing the Magic Back to Movie Theatres

By: Connor McSweeney

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

Reflection

From early films such as Bambi and Pinocchio to late 20th century successes like The Little Mermaid and Aladdin, Disney has brought magic into the lives of billions since its founding by Walt Disney in 1929. His legacy lives on through a company that has maintained strong value creation while adding new brands along the way—most notably Pixar, Marvel, Lucasfilm, and 20th Century Fox. Having produced six of the top ten grossing movies of all time and amassing 38 percent of North American box office revenue in 2019, there is no question that Disney has created and captured significant value through its Studio Entertainment Group. The company has expanded upon and reinforced its strength in film with a company flywheel that includes theme parks, merchandising, cruise lines, and television networks.

More recently, Disney has looked to build brand engagement through its new Direct-to-Consumer and International (“DTCI”) strategy built on its streaming platforms. To complement its content creation, the company has created a suite of streaming platforms, launching itself into virtual content distribution. Disney+, the most recent and substantial to date, was launched in November 2019 with nearly 500 films and 7,500 episodes of television from Disney, Pixar, Marvel, Star Wars, National Geographic, and more. The platform is the exclusive home for some of the world’s most beloved stories. With a base price of C$11.99/month or C$119.99/year, Disney is trying to penetrate the streaming market historically dominated by Netflix and subject to new entrants from companies such as Comcast (Peacock), Apple (Apple TV+), and AT&T (HBO Max).

A Whole New World

Streaming platforms have changed the way consumers interact with content. From 2015 to 2020, the industry grew at a 24.8 percent CAGR and it is expected to grow by 23.2 percent annually between 2020 and 2025. Disney has already begun to capture this growth, having acquired nearly 100 million Disney+ subscribers in just over one year of operations, exceeding the company’s four-year target of 90 million subscribers. This resulted in subscription revenues increasing by over $5 billion and more than tripling the prior year’s revenues derived from Hulu and ESPN+ alone. In contrast, Disney’s theatrical distribution revenue from its Studio Entertainment Group fell 55 percent in 2020 due to the deferral or cancellation of significant movie releases, mainly driven by theatre attendance falling 81.9 percent as a result of COVID-19 linked shutdowns.

At first glance, it would seem that Disney+ could represent not just a treasure chest for premier content, but the future of content distribution for Disney as a whole. However, both content providers and audiences still consider theatres important, which suggests that Disney’s problem is not how to best capture value in content distribution, but how to extend emotional brand engagement beyond its digitally-focused DTCI strategy.

Why Disney Needs Movie Theatres

Movie theatres remain the cheapest and most effective way to promote a film and create an ancillary market for content. In a world where there are 500 million Tweets per day and the average consumer encounters 6,000 to 10,000 advertisements daily, it can be difficult and costly to advertise content at the right time and in the right place. Additionally, creating an ancillary market for content allows movie budget costs to be recouped and additional perpetual returns to be generated. This investment in IP is particularly important for Disney, which generated $16.5 billion in ancillary revenue from merchandise, parks, and experiences in 2020.

The impact of the collapse in theatrical releases has been reflected in Disney’s distribution strategy. Despite having an online-only release for Mulan, Disney’s reluctance to release Flora & Ulysses and Raya and the Last Dragon exclusively on Disney+ illustrates that online distribution is a temporary COVID-19 solution rather than the future of film distribution. Furthermore, larger films such as Black Widow will be released in theatres first and will hit Disney+ only after the big-screen release. At its 2020 Investor Day presentation, Disney announced that its release strategy would not completely abandon theatres, with more than 40 movies still scheduled for theatrical release. Despite the tremendous performance of Disney+, this suggests that the company as a whole is still very much tied to theatrical distribution.

Audience Perceptions of Movie Theatres

The Movie Theatre Association of Canada categorizes moviegoers into four groups based on frequency of theatre visits: Never (zero movies per year), Light (one to two movies per year), Moderate (three to nine movies per year), and Heavy (more than ten movies per year).

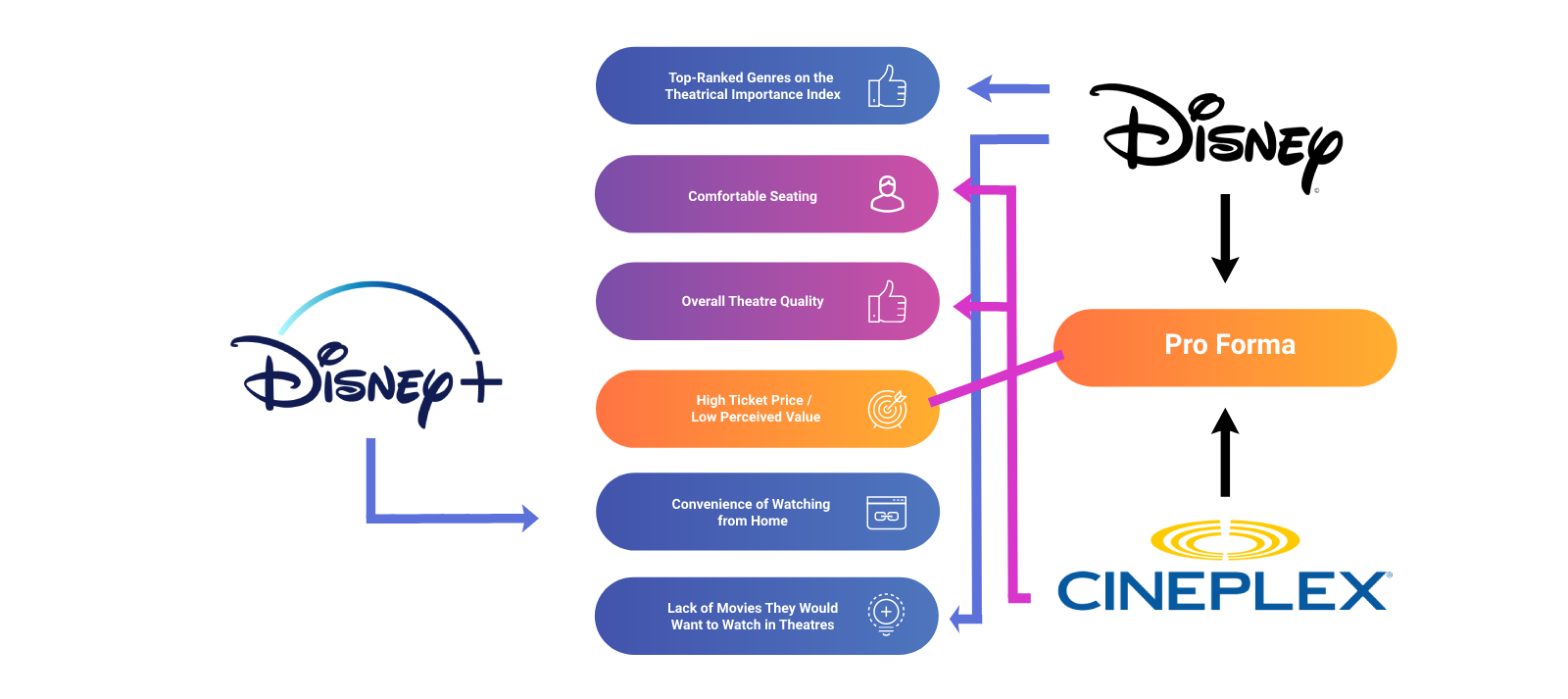

For moviegoers, the biggest pull factor is genre—moviegoers rank action (57 percent) and superhero (48 percent) highest on the Theatrical Importance Index. Theatres provide the means to experience these exciting genres in the highest quality, with experiential factors including comfortable seating and realistic 3D visuals. On the opposite end of the spectrum, the largest deterrent that stops moviegoers from watching films in theatres is cost. However, it is not the economic cost of a movie theatre visit that has increased, but rather the perceived value of moviegoing that has gone down. Canadian movie theatre prices only increased by 1.60 percent annually between 2006 and 2020—below the average rate of inflation. Despite this, consumers have less reason to watch movies in theatres as they now have access to an immense collection of content for a low subscription fee. At the end of the day, the decline in consumer affinity for theatres threatens emotional brand engagement for all content creators, including Disney.

The Bare Necessities

Disney has currently positioned itself well on the Theatrical Importance Index by producing a significant number of action and superhero movies. However, Disney has limited-to-no control over movie tickets whose perceived value is derived from experiential factors, such as comfortable seating and overall theatre quality. To increase the perceived value of a movie ticket, Disney should enter into theatrical distribution to rekindle excitement around the moviegoing experience and increase emotional brand engagement.

Consolidation within the movie theatre industry has resulted in fewer players controlling more market share. 63 percent of the US market is controlled by Cineworld, AMC Entertainment, and Cinemark. In Canada, 59 percent of the market is controlled by Cineplex alone. Compared to smaller theatre companies, these four players all have higher-quality movie theatres in strategically superior locations, resulting in greater theatre attendance. As such, Disney should look to acquire one of these major players with considerable market share and a sizable audience.

Bringing the Magic Back to Movies

Disney should acquire Cineplex to take advantage of its strong foothold in the Canadian market. Cineplex’s dominant market share has allowed it to continuously secure licenses to screen blockbuster films, becoming the go-to theatre chain in Canada for major releases. Additionally, Cineplex typically owns theatres in higher population areas, making it an attractive platform for movie distribution. Given Cineplex’s currently low valuation and the potential to realize operating synergies, this transaction would be accretive on many key forward-looking financial metrics, thus representing an attractive opportunity.

For Disney, this is an opportunity to be proactive in a pseudo test-market where it currently maintains no theme parks nor resorts. Disney can combine its experiential and financial capabilities with Cineplex's strong positioning in the Canadian market to revitalize the movie theatre experience in Canada. Improving the experience will not only increase attendance for the benefit of all content producers, but it will also increase the value of Disney’s other businesses including Studio Entertainment and Parks, Products and Experiences.

From a financial perspective, this acquisition would allow for significant operating synergies to be realized. In addition to corporate cost eliminations of C$40 million, Disney would be able to forgo cash outflows related to film licensing. In 2019, Disney sacrificed revenues of C$110 million in the Canadian market due to licensing agreements that required content distributors to pay producers 52.4 percent of box office revenue. As a result, Disney could realize up to $150 million in operating synergies in total, 73 percent of which would be perpetual. At Cineplex’s current distressed valuation, a 30 percent premium all-stock transaction remains accretive to Disney’s EBITDA and Free Cash Flow despite movie theatres’ traditionally inferior margin profile. This results in a total purchase price of $2.4 billion, just over 30 percent of Disney’s 2020 operating cash flow and well under its current cash balance of over $17 billion.

A New Hope

After acquiring Cineplex, Disney should work diligently with Cineplex’s team to improve the perceived value of a movie theatre ticket and build emotional brand engagement between moviegoers and Disney franchises. There are two primary actions Disney can pursue to achieve these objectives: creating “Disney Clubhouses” and expanding the reach of VIP Auditoriums.

Disney Clubhouses

The proposed “Disney Clubhouse” implementation would see select theatres fully transformed into themed, Disney-only venues. These locations would be renovated to include dedicated theatre areas that replicate content from different Disney movies. For example, a Marvel section would enable moviegoers to feel as if they are in Wakanda or on Asgard. By using augmented reality billboard technology widely used in Asia, Disney Clubhouses would be able to reflect current content and enhance the experience for younger moviegoers. The Disney experience would be further brought to life through revamped in-theatre activities, such as birthday parties.

Enhancing the moviegoing experience with this strategy will rekindle emotional brand engagement among the next generation of moviegoers. The enhanced experience for younger moviegoers will justify a premium price point to parents. This will additionally create a new distribution channel to sell Disney merchandise in theatres, further strengthening ancillary revenues.

VIP Auditoriums

Beyond the movie itself, moviegoers are driven by comfort, cost, and convenience above all else when deciding where to go to see a movie. Thus, expanding the reach, both through quantity and accessibility, of VIP Auditoriums will increase the perceived value of a movie theatre ticket. Currently, Cineplex operates 84 VIP Auditoriums where moviegoers can order food and alcoholic beverages to their seats and engage in an all-inclusive moviegoing experience. These auditoriums are either a dedicated section of an existing Cineplex location or standalone VIP locations. They are designed to better reach the adult market and to increase both purchase frequency and transaction value. However, this strategy seems to have been put on hold as Cineplex’s financial position deteriorated sharply in 2020, leaving it unable to make the necessary investments to improve the VIP offering. Disney can use its financial capabilities to support the integration of more VIP Auditoriums in theatres across the country. At the moment, VIP Auditoriums only represent 5 percent of total screens. More VIP Auditoriums can contribute to more revenue per patron, hence increasing the perceived value of moviegoing.

To Infinity and Beyond

Disney is already executing well on its promise to become a direct-to-consumer (“D2C”) company through the release of its suite of streaming products. However, a D2C business strategy should not be limited to digital solutions. Should Disney abandon theatrical distribution, it risks compromising the box office model that has enhanced ancillary market value for its brand. Through acquiring Cineplex, Disney will be able to address the root cause of deteriorating theatre attendance: perceived value. The acquisition will allow Disney to reinvigorate the moviegoing experience for current and future generations of moviegoers. In doing so, Disney will be able to build stronger brand engagement and bring the magic back into the moviegoing experience.