Under Armour: The Only Way Is Through Brand Partnership

By :Justin Li & Shivani Pradhan

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

Riding the Bench

Since its inception in 1996, Under Armour has been recognized for its performance fabrics that help consumers realize their full athletic potential. With $5.3 billion in global sales in 2019, Under Armour is ranked as the fourth leading athletic apparel, accessories, and footwear company. However, fourth place may be just as good as being on the bench in the fitness apparel and accessory industry. The company has struggled relative to industry leaders like Nike, Adidas, and Lululemon, especially in North America. This presents a key issue, as North America comprises 69 per cent of the company’s global 2019 net sales revenue. Subsequently, Under Armour has seen its stock price decline 62-per-cent over the last five years.

This decline in sales revenue can be attributed to several reasons. One of the primary drivers is a shift in consumer preferences from performance-focused sports apparel to more fashionable alternatives, with brands like Adidas significantly outperforming Under Armour. Through its highly successful portfolio of athleisure footwear and collaborations with high-profile celebrities such as Pharrell Williams and Kanye West, Adidas has seen its stock price skyrocket over 200 per cent over the last five years. Under Armour has attempted to replicate this success by collaborating with prominent celebrities like A$AP Rocky, but its focus on performance and lack of consumer familiarity in the athleisure and streetwear space have been barriers to this strategy’s success.

Another driver is Under Armour’s reliance on wholesale distributors to sell apparel in North America. Decreased demand from these wholesalers due to bankruptcies and declining foot traffic suggests that the brand’s distribution strategy is also contributing towards declining sales revenue. Approximately 90 per cent of Under Armour’s North American stores are outlet stores. While the outlet stores provide a necessary avenue for Under Armour to sell last season’s clothing, deep discounting at retail outlets suggests that Under Armour’s brand equity has weakened and the company has lost pricing power. These factors have ultimately led Under Armour’s brand perception to decline. While Nike and Adidas are respectively ranked as first and third of the 2019 Top 50 Most Valuable Apparel Brands by Brand Finance, Under Armour dropped from 19th to 25th from 2018 to 2019.

Despite Under Armour’s former CEO, Kevin Plank, stating that the company would “double down on performance” at the end of 2018 and focus on core competencies, the company has failed to rejuvenate its sales growth since. It has become clear that Under Armour must change its brand perception to adapt to the current retail landscape and re-establish its place as a leading sports apparel provider.

Emergence of Tech and Fitness

Recent technological advancements have allowed consumers to enhance their workouts. Wearable technologies such as FitBit have enabled consumers to track health information, allowing them to easily understand their fitness performance and progress. Apple Watch has also experienced great success as a result of Apple’s refined ecosystem. These technological advancements have been met with strong enthusiasm: 80 per cent of consumers have expressed interest in wearing fitness technology, and the wearable technology market is expected to reach $54 billion in annual revenue by 2023.

Under Armour’s previous attempts to capitalize on the wearables market have failed. Under Armour’s Health Box, a kit of wearable smart technology, failed to compete against FitBit and Apple Watch, reporting an operating loss of $44 million after just one quarter.

Beyond just wearable technology, advancements in streaming have also enhanced the workout experience. Technology companies such as Peloton and Mirror have allowed consumers to stream workouts led by high quality instructors inside the comfort of their own homes, improving the at-home fitness experience. While at-home workouts are becoming increasingly popular, the demand for traditional gyms still exist; the gym franchise industry is expected to grow at an annual rate of 2.6 per cent until 2024.

Conversely, brands such as Peloton have seen success due to their luxury connotations that appeal to exercise enthusiasts. To effectively capitalize on these trends, Under Armour must be able to deliver a premium experience, provide users with a greater incentive for adoption, and drive habitual use.

Emergence of Boutique Gyms

Experiential boutique fitness clubs—gyms with niche product offerings—are an industry trend that Under Armour could capitalize on. Between 2012 to 2015, memberships to boutique fitness studios grew by 70 per cent while “big-box gym” memberships only grew by 5 per cent. The American College of Sports Medicine’s Health and Fitness Journal ranks activities found at such gyms, including group fitness, high-intensity interval training, and functional fitness training at second, third, and ninth in popularity, respectively. Strong interest in unique experiences over traditional workout routines, whether through boxing, indoor cycling, or yoga, has contributed significantly to the increased popularity of boutique fitness clubs. The decrease in the size of the American middle class over the past few decades has resulted in more premium and discount gyms. Gyms like Planet Fitness offer very affordable and accessible hours, whereas Equinox and its portfolio of brands such as SoulCycle provide a premium experience that attracts customers looking for a specialized workout experience.

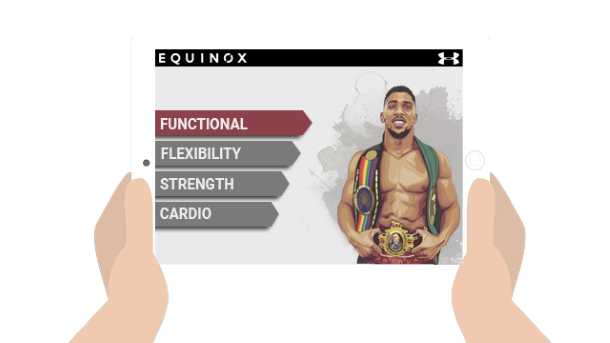

Under Armour & Equinox

Under Armour should seek new opportunities to market its products in new venues through a strategic partnership with Equinox. With $1.4 billion in sales in 2018 and a diverse portfolio of brands that capture the upper class fitness enthusiast market, Equinox is the ideal fitness club partner for Under Armour. With SoulCycle “boasting 13 years of brand building, and Equinox just shy of 30”, Equinox has not only the financial capabilities and dedicated consumer base, but also the positive brand associations to uplift Under Armour.

Such a partnership will enable Under Armour to leverage its prior expertise in fitness tech and portfolio of prominent celebrity athletes to enhance Equinox’s fitness club offerings and provide consumers with a high-end, premium impression of the Under Armour brand.

Virtual Classes

With various high-profile athletes such as Stephen Curry, Anthony Joshua, and Tom Brady signed on with the Under Armour brand, the company can create and film virtual class content that complement the various fitness offerings Equinox currently offer. Virtual training sessions can be shown on large screens in interactive rooms where guests are coached by professional athletes, while still receiving live feedback and critique from trainers in the room. The allure of a boxing class designed in collaboration with heavyweight champion Anthony Joshua would be tremendous—not unlike the appeal which has driven the success behind the online education platform, MasterClass. By providing video classes filmed by stars such as Serena Williams and Gordon Ramsay, MasterClass has proven that there is significant demand for classes taught by high-profile celebrity experts. This content will also synergize well with Equinox’s venture into on-demand in-home fitness, scheduled to launch in late 2020. By getting Under Armour’s brand and celebrity athletes both at the gym and at home, Under Armour will significantly increase its brand exposure among fitness enthusiasts.

Wearable Tech

Under Armour can also introduce its investments in fitness technology into Equinox’s clubs, further enhancing the premium workout experience that the brand is known for.To emphasize Equinox’s current experience-based value proposition, Under Armour can enhance the social aspects of exercising through an app that pairs with wearable tech and in-gym hardware. Connected fitness experiences like Peloton, The Mirror, and Zwift use fitness equipment that enables users to gain deeper insights on their workout and record their performance improvement over time. With Equinox launching a similar at-home device, an Under Armour branded wristband like that of OrangeTheory would further supplement workout experiences with physiological data such as heart rate or calories burned. Since technology-focused hardware that lack a social aspect, such as Fitbit, face an abandonment rate of approximately 30 per cent, the human interactions brought forward by the Equinox partnership are crucial for the success of Under Armour’s wearables.

While Under Amour’s wearable tech products have seen lackluster performance in the past, the cross-branding opportunity introduces a new consumer base comprised of Equinox members, encourages habitual adoption, and lends legitimacy to Under Armour’s products.

Apparel Sales

Ultimately, the partnership with Equinox needs to rejuvenate sports apparel sales, which still make up 66 per cent of Under Armour’s revenue. To do this, Under Armour should seek to design new lines of athletic clothing and footwear co-branded with Equinox and exclusively available to members. By including its most premium performance fabrics, the clothing should not only satisfy the functional expectations of high-performance fitness enthusiasts, but also serve to add to the prestige of being a member of a premium fitness club such as Equinox. This creates a positive feedback loop where more members will be drawn to the Under Armour brand due to its association with a premium fitness experience, further increasing its brand recognition and appeal.

Additionally, with Under Armour’s branded retailers such as Sports Authority, Sears, and Macy’s closing stores and minimizing their brick-and-mortar presence as mall traffic declines, selling products in more experiential spaces such as Equinox are beneficial to boosting financial performance. Furthermore, selling products at gyms will provide Under Armour with more control over its pricing strategy, allowing them to regain a premium brand perception while simultaneously realizing higher margins.

Let the Games Begin

Under Armour and Equinox should launch this cross-branding opportunity under Equinox’s primary gym brand to capitalize on the premium brand perception. Further, the firms should stagger launch, starting out in major metropolitan hubs like Los Angeles and New York. Through an invite-only trial for high-profile and high-net-worth individuals, as well as a comprehensive social media campaign, Under Armour can increase both perceived exclusivity and awareness for the initiative. Its 2020 “The Only Way is Through” ad campaign was created fully in-house and features several of Under Armour’s prominent celebrity athlete partners such as Stephen Curry and Michael Phelps. Similar promotions could enable Under Armour to remind customers of its corporate identity while setting the stage to launch a brand partnership with Equinox.

With the success of the Equinox partnership, Under Armour could begin examining further opportunities in the gym industry to increase its brand perception. Events such as pop-up gyms for basketball where celebrity athletes like Steph Curry could hold workshops would drive even more merchandise sales and awareness.

From the Bench to the Starting Lineup

Equinox has approximately 400,000 members enrolled in its 106 name brand premium gyms. Assuming that 10 per cent of members are introduced to Under Armor apparel through new streaming classes and cross-branding, the initiative can realize $175 million in revenue over the next five years. While this revenue would allow Under Armour to break even on partnership and R&D costs, most of the top-line growth will come from spillover effects and publicity. With a new premium perception making the brand more attractive, as well as additional media attention, Under Armour can grow its market share in non-performance customer segments significantly.

A New Era for Under Armour

Pursuing an Equinox partnership would enable Under Armour to defend its position through leveraging its strengths in brand partnership and connected fitness. By developing a premium brand perception through associations with Equinox, driving tech wearable and apparel sales, and reaching a new customer base, Under Armour can finally step onto the athletic apparel podium.