Enguard: The Battle for Tenants

By: Anuraj Naithani

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

Smart cars, smart grids, and smart appliances – multiple facets of people’s everyday lives are moving toward smart technology. It therefore makes sense to add some intelligence to the one location newly graduated analysts will be spending the vast majority of their time. Imagine walking into the office after getting stuck in traffic and being able to control the heating and lighting from your smartphone, having already notified your colleagues through an internal enterprise network about being absent at the meeting. All this is achievable in a “smart building”. A smart building uses distributive control system technology to connect processes and systems within an office space and make it easily controllable by users through the internet. It improves the experience of people within it and increases their productivity, while also reducing operating costs. This represents a growing opportunity for real estate management companies to offer superior workplace environments for their tenants.

Within the next four years, the Greater Toronto Area (GTA) is expected to face an oversupply of office space. As a result, competition in the industry, particularly in the downtown periphery, will become increasingly fierce, with property managers battling to retain existing and attract new tenants. In particular, Morguard Corporation is already beginning to fall behind with much higher vacancy rates than its competitors. Management has been satisfied to-date with their strategy as mainly a Class B player, although with some of its properties already becoming unprofitable, Morguard needs a strategic shift if it hopes to see a rise in tenants and a more profitable commercial portfolio. In order to become competitive, Morguard should retrofit existing office buildings and make them “smarter”, with the main intention of improving tenant experience and lowering operating costs.

Developments in Office Real Estate

In the last 14 years, Toronto has seen almost a 15% increase in office space supply and expects an additional 4% increase in the next four years. Historically, Toronto net office space absorption rates have remained steady when compared to growth and have not resulted in a shift in vacancy rates. However, these trends are changing and growth in supply is forecasted to outpace demand. The increase in vacancy rates is expected to be most prominent in the peripheral GTA region. While the GTA’s current average office vacancy rate is at 9.4%, the peripheral office buildings are as high as 12-13%, compared to the financial district with 6.5% . The disparity is a result of large corporations moving their offices downtown, away from the suburbs, in order to retain superior talent that prefer to live and work in the downtown core. Differences in vacancy are also seen in the quality categorization of office buildings into Class A, B, or C. While Class A properties have been shielded by the relative inelasticity of premium office space, the vacancy rates of Class B and C buildings have been particularly affected by the increase in supply.

In a battle to retain existing tenants and attract new ones, property managers in the GTA have been retrofitting many of their commercial buildings to make the office spaces more cost effective by improving the building’s operating efficiency. Specifically, LEED certification has become a standard for tenants as it indicates a property’s commitment to sustainability through a rating for building design in six categories, including water efficiency, indoor environmental quality, and innovation in design. With the change in landscape and new retrofits being completed, competing in the GTA office property segment becomes increasingly difficult.

Morguard Corporation

Morguard Corporation (Morguard) invests and manages properties in North America with a diversified portfolio valued at more than $15B. A third of its properties fall under the office and industrial segment, and 75% of these properties are located in Ontario. Traditionally, Morguard has performed well, largely due to the strength of the real estate market, despite having been slower than competitors to retrofit their existing buildings. Recent industry pressures in the GTA have started to negatively affect portfolio performance, with some of Morguard’s building vacancy rates showing double to triple the rate of the leasing district average. The office and industrial segment has already begun to seen a decline in net operating income per gross lease area (sq. ft.) to $13.2 in 2013 from $14 between 2009 and 2012. Given that Class B properties make up the majority of its portfolio, this figure will be further affected as real estate supply continues to increase.

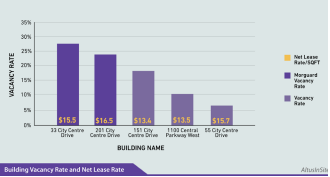

Morguard has two existing office properties located in Mississauga: 33 and 201 City Centre Drive. The buildings are aged, with the highest vacancy rates to similar buildings in the area, despite comparable leasing rates. Mississauga has seen a greater increase in supply of office space in 2014 compared to any other year within the last decade . Due to the oversupply, vacancy rates in the GTA West region are predicted to continue increasing, putting 33 and 201 City Center Drive further at risk. Similarly, many other properties in Morguard’s portfolio are experiencing the same challenge. Morguard needs to find a way to differentiate its properties to improve its bottom line.

A Deal with Cisco Systems

Cisco Systems is the only enterprise networking company of its size in Canada currently providing end-to-end real estate solutions through its Smart + Connected Real Estate team. Its technology connects all existing endpoints from both the informational technology and the building automation systems. This convergence of systems onto a secure, highspeed optic fiber from their relative disparate networks forms the basis of a smart building, connecting “everything” within a building. The building will be able to monitor and react to system changes in real time, seamlessly change the internal environment, network with the external environment, and optimize its own performance. Connecting people, processes, and data in a building over the internet can benefit tenants in a variety of ways. Tenants can increase staff efficiency through automation, personalize their preferences, and monitor lighting and other systems to reduce energy consumption. Additionally, these efficiencies have the potential to create significant cost savings.

Retrofitting Morguard’s properties by contracting Cisco Systems to make them smarter will differentiate its buildings from those of its Class B competitors while decreasing operating costs, providing greater incentive for new tenants. Morguard should start by retrofitting 33 City Centre in Mississauga to test the economics of the project. This property has one of the highest vacancy rates in the area of any building its size. The last retrofit completed was eight years ago, and was primarily focused on interior design. According to the Journal of Sustainable Real Estate, the gross cost of a retrofit of all major energy systems for a 500,000 square foot office building ranges $10-$20 per square foot, with a premium of $3-$31 for a deep retrofit. Indeed, a smart retrofit solution does not involve significant capital compared to typical retrofits and new construction. This venture can be easily financed with Morguard’s current cash reserves as its cash flow from operations have been increasing steadily since 2009. Morguard’s ability to integrate smart technology into their properties will be the key to decreasing vacancy rates and driving profit.

The Intelligent Solution

As 33 City Centre was built in 1977, many of its existing mechanical, electrical, and plumbing systems are aged, and operate as independent units; there is little connectivity and communication between the systems causing vast room for improvement. The base components for 33 City Center would be integrated using a core fiber optic network enabled by routers, switches, and wireless technology. Additional Cisco Systems hardware and software would play an integral part in making a building smart, including:

Unified Communications and Collaboration: This includes voice, and video hardware, instant messaging services, and enterprise social platforms, making communications between individuals internally and externally faster and more effective.

Connected Safety and Security: High quality video surveillance software and IP cameras that can be accessed and controlled by staff onsite from their mobile devices. This enables more effective security monitoring and quicker discovery of any breeches.

Environmental Controls: Automated and adjustable control of lighting, HVAC and blinds would deliver energy efficiency and savings. The communications system would be connected to provide real-time monitoring through thermostats, motion and solar sensors, and energy usage.

Data Centre: The installation of a data center within buildings will make IT processes faster for all tenants, reduce their expenditure on IT equipment, and enable cloud computing.

Customized additional hardware and software solutions will vary depending on Morguard and the tenants’ preferences for 33 City Centre.

A Strong Business Case

Smart building retrofits are an innovative form of reconstruction, with new add-ons being developed regularly. For this reason, there are few retrofits that have been completed and operating for numerous years. A similar retrofit was completed on Pennzoil Place, an office building in Houston, Texas. In 2011, Cisco was contracted to retrofit the tower, and under it the property was able to realize a 21% decrease in energy costs within the first year from increased operational efficiency. It also led to the building obtaining LEED Gold certification and was named one of the smartest buildings in the United States. While the cost of the retrofit is unknown, the building broke even in approximately two years, allowing for significant returns on the total project. Though Pennzoil Place cannot be used as a direct comparable due to the vast size difference, 33 City Center can expect similar cost savings from operating efficiency, bolstered by an increase in tenants, ensuring a significant return on investment.

Investment Payback

The oversupply of office space in the West GTA region implies that tenants can afford to be selective with choosing only the most attractive office spaces. The appeal of smart retrofitted buildings allows Morguard to offer a differentiated product within the class B industry, causing an increased demand for its office space. A smart retrofit of 33 City Centre will roughly cost Morguard $7.5M. The retrofit would result in both increased revenue and decreased operating costs. Assuming the retrofit increases demand with net rent staying at $15.50/sq. ft., every percentage decrease in vacancy would equate to an annual revenue increase of roughly $33,015. If 33 City Centre was able to decrease its current 27.5% vacancy rate to Mississauga’s average of 12.5%, it would be able to increase its revenue by $495,225 annually. The property will also experience substaintial cost savings associated with maintenance, water, and energy. Morguard should expect a conservative 7-year pay back period on its 33 City Centre retrofit investment. This aligns with the Canadian commercial real estate standards of an 8.5 year payback.

A Bright Future for Morguard

As the GTA commercial market still remains stable, it is important that Morguard implements this strategy quickly to ensure that it comes to market prior to other competitors doing a similar smart retrofit. The 10-year lease structure for tenants ensures that this would be a long-term competitive advantage for Morguard. The success of 33 City Centre should be a validation of smart building technology’s capabilities, resulting in the adoption of smart buildings as a portfolio-wide strategy. To do this, Morguard must identify struggling office properties on the basis of size, class, vacancy rate and location. Retrofitting these additional properties would increase the efficiency of Morguard’s portfolio and help to increase potential returns on these projects. With office supply increasing in the GTA, implementing the smart building strategy will ensure Morguard remains competitive in the long-term.