Cortana: Struggling to be Heard

By: Yaasir Dayani and Shehryar Mansoor

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

System Launch

Founded in 1975, Microsoft has come to revolutionize the personal computing space. Recently, the company cited artificial intelligence (AI) as a significant opportunity and has supported this interest through acquisitions of companies. These include Solair, which specializes in Internet of Things (IoT) services, and Genee, an AI scheduling assistant. These AI investments increase the firm’s sophistication and capabilities of key offerings such as Azure and Office 365 and support Microsoft’s AI platform, a series of intelligent tools and services for developers. Central to this effort is Microsoft’s intelligent personal assistant (IPA) Cortana, as it acts as a control centre for other connected hardware and software in its ecosystem. To stay relevant, Microsoft must establish a strong IPA and build out its integration to address the future of connected devices, since connected devices are expected to grow to 23.1 billion in 2018. Microsoft must look for ways to capitalize on its strengths in enterprise offerings and develop a strategy to excel in the fast-paced IPA and voice-enabled smart speaker market.

Intelligent Personal Assistants (IPA) & Smart Speaker Market

The $6-billion IPA industry has experienced explosive growth and is forecasted to expand at a compound annual rate of 34.9 per cent from 2016 through 2024. IPA products, initially available through smartphones, are now also accessible through wearable technology, computers, and stand-alone devices. A key addition to the IPA market is the emergence of the smart speaker, a stand-alone voice command device that carries the full functionality of the IPA. The smart speaker market has seen massive growth, with more than 39 million Americans now owning a smart speaker, up 128 per cent from January 2017. The smart speaker acts like a control centre for smart software and hardware, which make up the rapidly growing IoT market, estimated to be worth $561 billion by 2022. Subsequently, the smart speaker acts as an interconnective tissue between the integrated software and hardware products. As the market evolves, key success factors for both IPA and smart speakers will include low error rates in speech recognition; a wider variety of “skills”, functions and features used on the system; and compatibility with different smart-home and IoT products.

In the race to dominate the smart speaker market, Amazon and Google have emerged as clear market leaders thus far. As of Q4 2017, Amazon had captured 52 per cent of the U.S. market while Google held 36 per cent. Apple poses an immediate threat with the February 2018 release of the HomePod. These large incumbents have bet on smart speakers for many reasons. Amazon does not advertise directly through Alexa, rather, it responds to purchase queries with subtle sponsored or preferred product suggestions through its online e-commerce platform. In addition, Amazon has considered providing speaker data through voice transcripts to developers to expand the offerings available through the Echo. As the world’s largest digital advertising company with $90 billion in 2016 revenues, Google also seeks to benefit from the host of consumer data that can be gathered from smart speakers. This data can be fed into its AdSense network to provide users with more targeted suggestions. Using smart speakers, these companies are collecting valuable user data to power their core services.

Microsoft Cortana Background

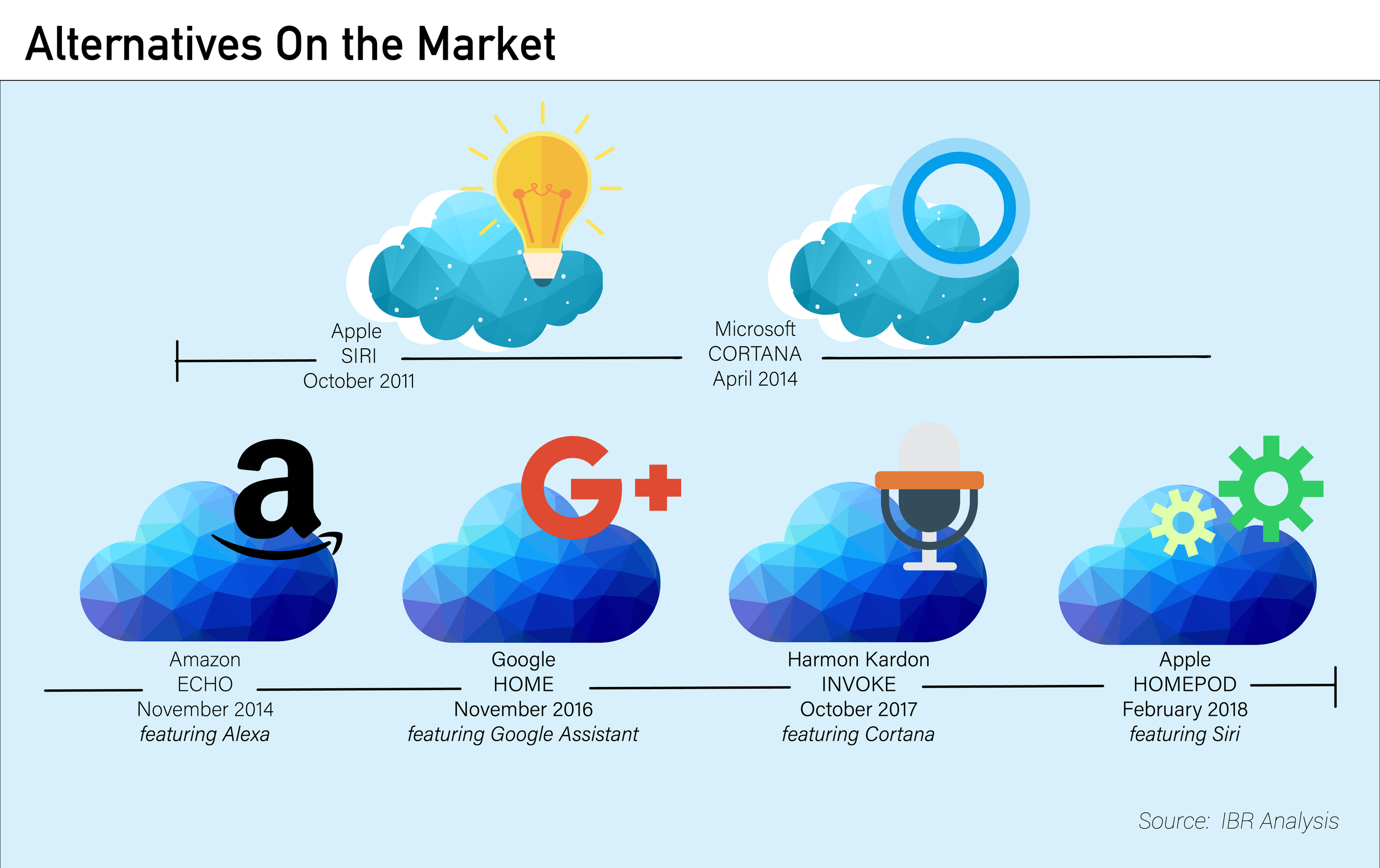

Microsoft first entered the IPA market through the release of Cortana in early 2014. By 2017, Cortana had expanded to Windows 10 Mobile, Windows 10 PCs, and Xbox One. The IPA has its technical merits; the speech recognition software used by Cortana has a 5.1-per-cent voice recognition error rate, lower than Siri or Alexa and in line with professional human transcribers. However, as competitors began pushing their smart speaker devices, Microsoft started to lag behind. The company’s Invoke speaker, launched in partnership with high-end speaker manufacturer Harman Kardon, was a late entrant to the market in October 2017. It launched nearly three years after the release of the Amazon Echo in November 2014 and nearly one year after Google Home in November 2016. Though the speaker features superior sound performance, Invoke is still struggling to differentiate itself with a meagre market share of 1.3 per cent.

CortaNot Working

Microsoft’s inability to capture significant market share stems from three major challenges with its IPA: lack of hardware integration, limited functionality, and insufficient voice data collection.

Poor Hardware Integration

Superior integration with other hardware and software is one factor that distinguishes IPA offerings from competitors. Google Assistant and Alexa are compatible with over 1,500 and 800 smart home devices respectively. In contrast, Cortana is only compatible with a handful. Microsoft has announced plans to bring Cortana to a greater number of devices in the smart-home market and has demonstrated this by forming partnerships with companies such as Honeywell and Geeni to produce more Cortana-powered smart home devices. However, competitors such as Google, Apple, and Amazon, currently have the advantage in consumer markets with their device compatibility and market share. Overall, inferior hardware integration and weak consumer focus will hinder Microsoft’s competitiveness in smart-home products. Microsoft’s strength lies in its strong footing in the enterprise software space where it can take advantage of integration with already-established technologies and platforms.

Limited Functionality, Skills, and Developer Base

A key value proposition of IPA products is the seamless integration with third-party applications and smart products through product skills. An essential aspect of functionality for an IPA is the breadth of skills offered. Amazon and Google offer developer kits that can be used to create specific applications for the two voice platforms. Microsoft offers a similar software development kit (SDK); however, it was launched in November 2017, far later than Amazon and Google. As a result, Cortana currently incorporates approximately 240 skills compared to Google Assistant’s 1,800 and Alexa’s 26,000. Furthermore, Amazon recently launched the Alexa Mobile Accessory Kit, which gives manufacturers the ability to connect to Alexa services via the Internet and integrate Alexa into a more diverse range of devices. Due to the lack of devices currently incorporating Cortana and the late launch of its SDK, the IPA has fallen behind in developing skills and establishing a solid developer base. As developers continuously choose larger platforms, such as Alexa, a negative feedback loop will be created, causing an ever-widening functionality gap between Cortana and other IPAs.

Lack of User Data

A key competitive asset for companies in this space is the voice data collected by voice-enabled smart speakers. Through their always-on feature, IPA products use machine learning algorithms to improve their accuracy over time. As samples available for learning increase, the algorithm adapts and improves its understanding of user commands to provide more accurate answers and actions. Companies, such as Google, with 15 exabytes of user data, feed voice data into their IPA products, allowing them to better understand user commands and improve overall performance of the products. As a result, high levels of data collection are key in driving IPA learning.

Cortana in the Enterprise Space

To succeed, Microsoft must address Invoke’s limited functionality, hardware integration, and user base. Microsoft has held a strong foothold in enterprise applications—its Azure platform commands 10 per cent of the public cloud market share, while its Office 365 suite surpassed Salesforce to become the most widely used enterprise cloud tool. Compared to Amazon, Google, and Apple, Microsoft’s strengths do not lie in the consumer market, but rather in the B2B space. Given its competitors’ successes in integrating collected data with their existing strong product offerings, Microsoft should refocus its resources to launch Cortana speakers designed for business use. With this speaker, Microsoft will pivot the focus away from consumer-facing smart home products to an intelligent productivity tool, ultimately using the data gathered to enhance its business analytics tools and paving the way for future personal assistant ventures. This tool will target the smart workplace, a $22.2-billion market that includes technologies promoting connectivity in workplaces.

Business Use Cases

Cortana is already integrated within existing Microsoft products, presenting an opportunity to provide increased utility to business users. Commercial products, such as LinkedIn, Skype for Business, Outlook, Azure Active Directory, and Power Business Intelligence (BI), can be integrated with Cortana to increase office productivity. For example, Word or OneNote could be used to take audio input through Cortana to transcribe text, while tools like Excel will be able to organize data and use voice commands to perform basic analysis. Similarly, Outlook could use Cortana to organize emails, meetings and schedules. Cortana could also be integrated with Microsoft analytics tools such as Power BI. This tool provides the ability to create and monitor custom dashboards that can present data in different forms. Increased user data, skills and function developers, and client interaction will enhance Cortana’s functionality moving forward.

Cortana could also offer tailored solutions and skills for businesses. Within enterprises, Cortana can be integrated with internal user directories and intranet systems to allow for greater connectivity. Said integration and skills have already been brought to the marketplace by Alexa for Business, Amazon’s IPA offering for enterprise use. Key clients for Amazon, such as Capital One, have utilized tailored skills to check status updates for events and high-severity issues and have used the Alexa Business API to build self-enrollment capabilities for users. However, with Microsoft’s existing customer relationships and business software capability, the company is poised to succeed compared to competitors in this space.

Developing Skills & Implementation

To facilitate this release, partnerships should be created with firms that specialize in skills development, such as POSSIBLE Mobile and Mobiquity, to ensure Microsoft can scale quickly and without significant internal investment. Considering Cortana’s late entry into the market and competitors encroaching on the enterprise space, outsourcing this capability will reduce go-to-market speed.

Cortana should prioritize targeting its existing business customers. Microsoft could generate revenue by selling Cortana as an optional feature in existing enterprise software service. Alternatively, Cortana can replicate the same revenue model as Alexa for Business, the only major competitor within the enterprise smart speaker market. Under this model, Microsoft would generate revenue by charging a monthly fee for two components: the number of users, and the number of speaker devices. This model will generate a recurring revenue stream, compared to the one-time purchase model for speakers in the home market while simultaneously strengthening

Microsoft’s product ecosystem.

In addition to providing increased productivity, the collected user data can be fed into Microsoft’s suite of productivity tools, most notably Microsoft Azure and Power BI. Incorporating workplace data will enhance features and functionality, providing even more value to enterprise customers. In addition, Microsoft’s existing enterprise customer base offers the scale required for a substantial user base, ensuring Microsoft keeps up in terms of gathering user data needed to improve IPA functionality. Lastly, the scale of the operations will enable Microsoft to secure manufacturer contracts and a sizable developer base for future expansion.

Windows of Opportunity

As competition within the industry heats up, Microsoft has an opportunity to leverage its strengths and apply its IPA to a new market altogether. While all major players within the industry are focused on the race for smart home supremacy, Microsoft is uniquely positioned with its stronghold in the enterprise space. In an increasingly competitive environment, Microsoft must choose to adapt or risk missing out on an integral opportunity in the artificial intelligence market.