Linking The Network

By: Manpreet Toor & Alex Pires

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

There has been much talk about the market for data analytics, but little of it surrounds the lucrative talent and recruitment markets. Between software, services, recruiting staff, and recruitment consulting, industry estimates suggests employers are spending on average between 150%-200% of a person’s annual salary on employee replacement costs, which has pinned the global recruiting market to an estimated $130B. This reflects the high value companies place on human capital, the source of some of their most valuable assets: patents, trademarks, and goodwill. According to a study by The Conference Board and McKinsey & Company, while human capital priorities are of strategic importance, companies are failing to keep pace with the changing needs of the business landscape and failing to take advantage of new technologies. With the increased capability of data analytics, processes such as finding, selecting, and allocating human resources are becoming a fast growing opportunity for this technology. LinkedIn is well suited to engage this market opportunity.

Beyond External Networking

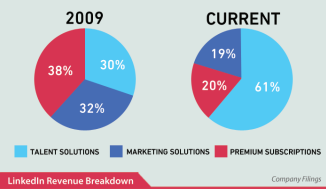

LinkedIn has earned more than $1.5B in revenue in 2013. Its Talent Solutions business unit, comprising of its employerfacing recruiting and hiring services, is the growing arm of the social network. In third quarter 2014, 61% of revenues came from Talent Solutions – more than double what it was in 2009. LinkedIn’s current product offerings are mostly catered to recruiting and job searching. However, once a LinkedIn user is hired, the user is less reliant on the platform’s revenue-generating job seeking services (such as LinkedIn Premium). There is also a drop in the potential to generate revenue through companies that have no more need for its recruiting services. In addition, while LinkedIn’s revenue has increased with a compound annual growth rate (CAGR) of 59% since Q3 of 2011, both revenue growth and user registration has declined at a CAGR of 29% and 24% respectively. Despite multiple acquisitions over the same time frame, it seems to have had little to no impact on the company’s decreased growth.

LinkedIn can offset its slowing growth trends by creating a product that engages customers beyond the hiring process. Internal human resource (HR) processes, such as talent retention, employee engagement, and organizational development, present a promising opportunity in a new wave of human capital analytics. Following their recruiting process, companies need to find the best ways to retain and use their human resources. Considering LinkedIn’s vast accumulation of data, stable infrastructure, and technological credibility, no one else is better positioned to develop solutions for the new needs of the HR space and capture this market potential.

A Departure from the Norm

This emergent opportunity in the HR space fueled LinkedIn’s acquisition of Bright.com, an artificial intelligence (AI) based service that determines a candidate’s fit for a particular position. This acquisition highlights LinkedIn’s commitment to establishing itself as an HR tool and will be the key driver behind LinkedIn’s expansion into internal enterprise solutions. LinkedIn should invest in the development of a proprietary human resources management and recommendation platform for both external recruitment as well as internal project allocation, as part of an internal version of its Talent Solutions business. This opportunity will create a new revenue stream and drive demand towards LinkedIn’s most valuable business unit.

Human Capital Analytics – Inside Out

Companies currently use an array of individual software tools to manage human resource requirements for internal succession planning, external hiring, and project resource planning. Microsoft Outlook, Microsoft Project, SharePoint, and other third party apps have all attempted to aid in this process of allocating human resources to projects, while larger customized enterprise resource solutions, such as SAP, are often employed for internal planning. Even so, there has yet to be a single dependable software that helps a manager best select internal and external talent.

In many organizations, the task of forming teams simply comes down to the decision of senior executives or resource availability. On multi-year, multi-billion dollar projects, poor team recruitment decisions have the potential to irreparably damage or bankrupt the company. As such, successful team formulation and choosing the right members for the right project is critical for human resource managers.

Using Bright.com technology to match candidates to job descriptions, LinkedIn can develop a resource recommendation solution for employers. This will identify ideal external candidates on LinkedIn for specific roles within a company, and the best internal candidates from a community of internal profiles. LinkedIn can combine the Bright.com AI with its existing enterprise analytical methods to predict future HR needs based on the terms of existing contracts and projected turnover. This means LinkedIn can provide continuous internal and external hiring recommendations for current and future job openings and create a non-cyclical, perpetual revenue stream based off of existing technologies. Employers will no longer need to exhaust internal resources to analyze requirements and actively search for the best candidate; with LinkedIn, it is easy for employers to “always be recruiting.” In order to maximize the benefits of this service to the employer, creating the necessary internal profile data is critical. LinkedIn can encourage employees to create data within the system by bundling the service with an enterprise social network.

Chatter, Yammer, Linker?

In 2013, LinkedIn CEO Jeff Weiner hinted at a possible expansion of LinkedIn’s product offerings into enterprise social networking, a space that includes Salesforce’s Chatter, and Microsoft’s Yammer. In November 2014, even Facebook announced it would be releasing a social platform for use at work. LinkedIn’s distinct competitive advantage, however, would be its ability to enter the market with a pre-established professional network, allowing for an immediate connection between the internal corporate and external platforms.

An enterprise social network expands and improves the quality of LinkedIn’s pool of user data. Employees gain accreditation that they can display on their internal profiles, which can be exported to external profiles at the discretion of their managers. Ultimately, employees will be encouraged to contribute content, as increased information can now be important for internal and external recruitment opportunities. This will ultimately enhance the accuracy of the proposed recommendation engine.

No More Wasting Time

An internal social network for any company encourages increased productivity through open communication and sharing. To help sell its human capital analytics and enterprise social network to HR departments at the world’s largest employers, LinkedIn must quantify the efficiency and productivity created from its service. According to the McKinsey Global Institute, productivity of knowledge workers in large organizations can increase by 20% through the use of social platforms. Social networks reduce the amount of time required to write and answer emails, and eliminate time-consuming searches for internal knowledge and expertise. Quantifiable efficiency gains can serve as further encouragement for user adoption.

Slack in the Chain

Despite LinkedIn’s current advantages of brand recognition among employers and the size of its professional social network, the company will need to catch up with the established and developing market players. As such, LinkedIn should acquire and integrate an existing platform rather than develop one inhouse. The eight month old start up Slack would make an ideal target. With $2.3B in cash, LinkedIn can afford to acquire the $1.1B start up. Slack is a team communication tool, integrated with third party services (Google Docs, Dropbox, GitHub), with over 268,000 active daily users. Slack gives LinkedIn direct access to over 30,000 teams and a sales channel for LinkedIn’s human capital analytics service. Corporate buy in at LinkedIn shouldn’t be a problem as their CEO Jeff Weiner is already personally invested. Once the internal talent solutions product is developed, LinkedIn should market the product via an enterprise Software-as-a-Service (SaaS) model, where the product is centrally hosted and licensed on a subscription basis. This would fit perfectly with LinkedIn’s strong core competency in running web applications, and offering cloud HR and communication solutions will simplify the product offering for potential customers. For companies worried about information security and against having confidential information flow through LinkedIn servers, the option of hosting information on client servers should also be explored.

Sticky Links

This new human capital analytics/enterprise social network product would create a significant competitive advantage for LinkedIn in the HR industry. Considering that the human capital analytics tools and the enterprise social network complement each other by providing and using each other’s data, LinkedIn should use a mixed bundling strategy for the two products to drive incremental revenue for both. A mixed bundling pricing strategy would also take advantage of firm’s differing reservation prices for the two products, expanding two high margin products and increasing adoption.

In order to gain a market foothold, LinkedIn should offer the product to employers for free in the first year, similar to WhatsApp’s pricing model. By offering the product free for the first year, and then converting to a freemium model (where the basic product is free but money is charged for additional functionality) with additional features priced on a modular basis, LinkedIn will have an opportunity to gain valuable customer feedback, and develop and test additional functionality requested by loyal users. Additionally, tiered features allow for increased revenues from LinkedIn’s existing customer base without the need to acquire new leads. This will lessen the burden on LinkedIn’s large sales force and drive organic growth.

Overall, this pricing strategy will improve user adoption upfront, enabling the network to quickly reach scale. The platform will create a stickiness that LinkedIn did not have with its enterprise customers before. LinkedIn’s social network and analytics tools will be a key part of the clients’ human resources backbone.

How to Link it All Together

With over 300 million users, LinkedIn can become the unchallenged leader in professional social networking. With their large user database comes immense and valuable data pertaining to users’ skills, employment history, educational background, and interests. Increasing data on LinkedIn’s internal platform, where employees can opt in to export said data at their managers approval to their external profile, enhances the value of LinkedIn’s external platform for its users and creates a network effect. This results in a full cycle of user engagement from the time people are looking for jobs, to when they are employed, to when they begin searching for employment again. This will continue to drive revenue growth in the Talent Solutions division and the lagging marketing and premium subscription segments (together half of LinkedIn’s revenue). The launch of a SaaS HR management tool and enterprise social network is a combined offering that can offer growth across major revenue streams and ensure LinkedIn continues to be the professional network of choice.