OpenTable: A Buzzworthy Partnership

By: Zoe Yang & Wes Jefferson Ong

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

An Entrée into Reservations

Since 1998, OpenTable has been committed to its mission of creating meaningful connections and bringing people together with the restaurants they love. Over the past two decades, the online restaurant reservation service has partnered with more than 47,000 restaurants worldwide. Today, the site now books over 26 million diners each month. Despite the company’s success, OpenTable’s offering lags behind its competitors. As more companies enter the market and offer cheaper prices, OpenTable must explore new strategies in order to keep its seat at the table.

On the Chopping Block

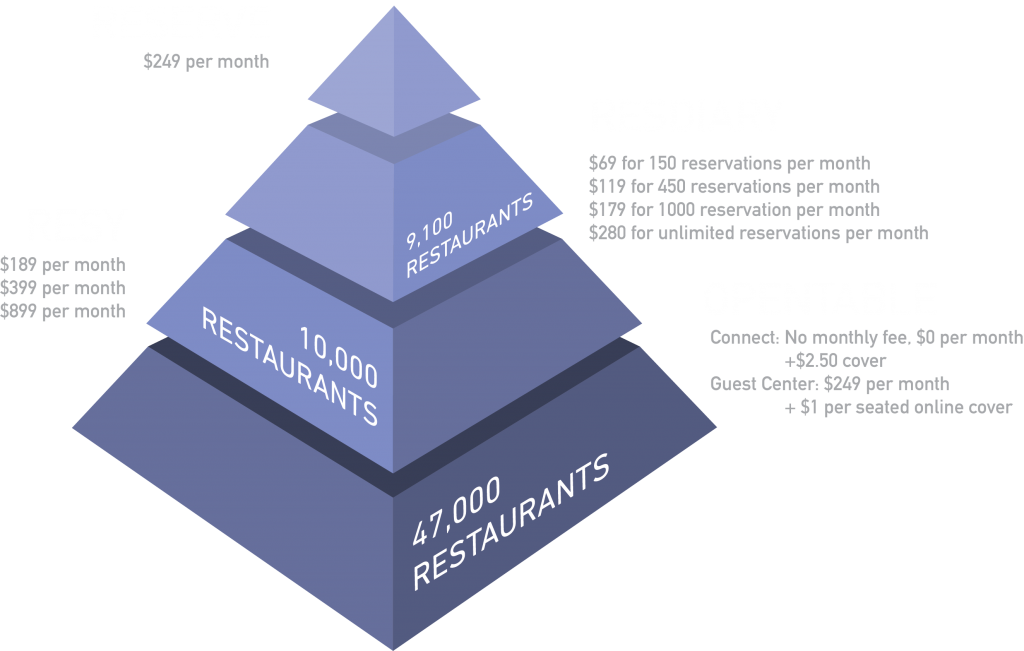

OpenTable was founded with the goal of making online reservations more convenient for both restaurants and diners. It provides restaurants with a software management system, a nationwide marketing network, and a popular customer destination website. Restaurants on OpenTable have the option of paying either a monthly subscription fee and a commission on each table booked through the platform, or a slightly higher per-booking commission with no monthly cost. As a pioneer in the reservation industry, OpenTable allowed restaurants to streamline their reservation process and adapt to customers’ changing preferences as diners shifted towards online reservations.

While the company experienced rapid growth in its early days, signs of weakness have emerged. At its peak in 2016, OpenTable held over twice the combined market share of its three closest competitors, Yelp Reservations, Quandoo, and Bookatable. This figure has since fallen to 1.3. OpenTable’s decline can be attributed to new competitors entering the space with aggressive tactics, featuring unique value propositions that cater to changing diner preferences, increased functionality for restaurants, and cheaper pricing models. For example, up-and-coming competitor, Resy, focuses on forming exclusive partnerships with the trendiest restaurants. Another platform, Reserve allows restaurants access to its data on diner preferences. Yelp Reservations charges restaurants a flat monthly subscription and no commission fees on bookings.

Competitive Pricing Table

OpenTable has already lost notable restaurants to competitors. In September 2018, Union Square Hospitality Group, owned by New York superstar restaurateur Danny Meyer, announced it would move its entire portfolio of restaurants to Resy. This came as no surprise, as Resy and Union Square Café had just completed a successful partnership, with Resy supplying a front-of-house Apple Watch solution that notifies restaurant managers in realtime when diners exhibit notable behaviour. Competitive tensions continued to climb as Resy announced in November 2018 that it would purchase competitor Reserve to expand its U.S. footprint.

OpenTable’s failure to keep up with the increasingly competitive reservations market has been recognized internally. In 2016, its parent company, Priceline, took a $941-million write-down on the company just two years after completing OpenTable’s acquisition. The justification for the write-down was OpenTable’s failure to successfully grow outside of North America and bring new restaurant partners onto the platform.

Strategic Alternatives

As the industry heads towards fiercer competition, OpenTable has two options: iterate upon its existing offering or drive out competition with lower prices. Given the size and resources of its parent company, OpenTable could force competitors out by undercutting prices. However, to successfully compete in a price war, companies must operate in an industry with high barriers to entry that prevent competitors from easily re-entering the market. In this case, the issue remains that OpenTable’s business model is easily replicable and competitors would simply re-enter once prices rise. To remain competitive, OpenTable should look towards opportunities to improve the user experience and make itself more indispensable to restaurants.

Since restaurants rely on reservation services like OpenTable to drive customer volume, the company can create more value for its restaurant partners by finding a new source of traffic that increases profits. To distinguish itself from competition, OpenTable should secure partnerships that funnel a sustainable stream off new customers to its restaurant partners. In addition, partnerships can aid OpenTable in adding a new dimension of customer insights to its database that would otherwise be difficult to procure. Ultimately, OpenTable could build a sustainable advantage in the reservations industry by providing unique diner insights to help restaurants gain a better understanding of their customer base, while providing its users with a more personalized experience.

Table for Two?

OpenTable should explore the opportunity of partnering with online dating apps since restaurants are one of the most commonly selected meetup venues for dates. Both types of platforms share a common vision of empowering people to create genuine relationships, whether through an app or over a great meal. By embedding itself within a dating application and enabling users to seamlessly book dinner plans, OpenTable can become the primary restaurant reservation platform for the platform’s dates. Through this partnership, OpenTable would increase the number of diners using its platform, thereby retaining more restaurants and attracting new clients.

The dating app Bumble stands out as an ideal partner. In addition to its primary dating service, Bumble Date, the platform offers networking tool Bumble Bizz and friend-finder Bumble BFF. All serve to give users multiple opportunities to meet up with new people and create genuine connections. The company furthermore has a history of being open to partnerships that add value to its users. In 2016, Bumble partnered with Spotify to allow matches to connect based on similar music tastes. In 2018, it established a partnership with Instagram to allow users to easily share photos with potential matches. The integration of a restaurant reservation service would be a similar move adding value for Bumble users.

Restaurant owners have cited exposure to new customers as a primary reason why they choose to partner with online reservation platforms. As users successfully find matches on the app or rejoin the Bumble community, OpenTable would have access to a constantly changing customer base, ensuring a sustainable stream of new traffic for its restaurant partners. In addition, Bumble has been experiencing incredible growth over the last two years, with its number of downloads having increased by 570 per cent. Through this integration, every new Bumble user would be exposed to OpenTable, giving the company the opportunity to directly participate in Bumble’s rapid growth. As OpenTable looks to enter new geographies, it can use Bumble’s existing presence to help appeal to local restaurants.

Integrating the Platforms

The integration of OpenTable into Bumble would allow matches to easily make reservations for meetups. After a match is made on Bumble, an OpenTable feed would appear, allowing users to browse available restaurants, select a spot, and make a booking directly within the app.

This partnership presents an opportunity for both Bumble and OpenTable to improve upon their respective value propositions. Bumble could further iterate on OpenTable’s features by allowing users to add cuisine and food preferences to their profiles. This would provide an effective conversation starter; in a sample of over three million dating profiles, users who mentioned specific foods in their profile saw a substantial increase in inbound messages. Bumble could also integrate food preferences into its match algorithm to find more suitable pairs and increase match success rates. In addition, restaurant suggestions within the OpenTable feed could be specifically targeted to the tastes and preferences of the two matched parties, improving reservation conversion rates for restaurant partners.

More Guests at the Table

Securing a partnership with Bumble would not limit benefits to just OpenTable; its restaurant partners would also realize value from the increase in customers. This access to a new stream of users would help OpenTable justify its prices and incentivize restaurant partners to continue using the platform as their main reservation tool.

In October 2018, Bumble had over 40 million users, up from 22 million users in November 2017. Assuming the company can maintain a similar growth rate, Bumble would expose 37 million new users to the OpenTable feature in the next year. Since two thirds of people dating online report going on at least one date, Bumble could reasonably expect to see at least 64.7 million dates in the next twelve months. Around a third of dates take place at restaurants and if 80 per cent of these matches use the app’s OpenTable booking service to reserve a restaurant, this partnership would drive approximately 17.3 million OpenTable bookings. Based upon OpenTable’s current market share, 10.3 million of these dates would not have otherwise used the platform.

More Buzz on Bumble

In this partnership, OpenTable would share a portion of incremental revenue as an incentive for Bumble to participate. If OpenTable gives Bumble a $0.50 royalty on confirmed reservations, less than the per-reservation amount it collects from restaurants, Bumble would experience a 4.3-per-cent increase on its $200 million in annual revenue. In addition to its financial benefits, the OpenTable integration would increase the ease with which users can arrange meetups, consequently improving user engagement and satisfaction.

Serving Success

The restaurant reservation industry is highly fragmented and filled with many homogenous platforms competing over the same customers. Although OpenTable was the pioneer in this market, its product offering now lags behind competitors. This partnership would act as a springboard for OpenTable to start building a comprehensive database of diner insights and preferences. The company could leverage this data to expand its capabilities beyond reservations and start offering diners a more personalized experience on the platform. These customer insights would also give OpenTable the opportunity to provide its restaurant partners with a better understanding of their customers and better target diners who would be likely to visit specific restaurants. Ultimately, OpenTable would be able to re-establish its presence and ensure that it reserves its spot at the head of the table.