Organic Growth

By: Nancy Zhao

The Ivey Business Review is a student publication conceived, designed and managed by Honors Business Administration students at the Ivey Business School.

The US organic foods market has undergone staggering growth, from sales of $1B in 1990 to to $35B in 2014. Recognizing the potential of the increasingly health-conscious American consumer, Whole Foods has successfully captured part of this market with its unique grocery-retail business model focused on organic and locally sourced foods. Its meteoric rise in popularity and sales compound annual growth rate (CAGR) of 14% has not come without notice however, and the US grocery goliaths have begun to respond. For instance, Wal-Mart has increased its organic foods offerings over the last decade to include hundreds of items, and this year began a partnership with organic food operator Wild Oats to sell more affordable organic products. Similarly, Kroger, the second largest US general retailer after Wal-Mart, has launched a billion dollar line of organic products under the brand “Simple Truth Organics”.

These new entrants, attracted by the high profit margins of organic foods, are placing increasing downward pressure on prices as they fight for market share. With organic food offerings becoming commonplace in grocery retail, Whole Foods is finding it more and more difficult to justify its premium prices to customers. Although influential in driving the organic food trend, Whole Foods has become a victim of its own success as increased competition is forcing the company to drop its prices. This price decline contributed to a contraction in its gross, operating, and profit margins for the first time in five years.

Growing Pains

Whole Foods successfully established itself as a dominant player in the organic foods industry for a number of key reasons. Not only did it become a driving force in the creation of organic food standards, but the company also dedicated itself to supporting local communities and environmental initiatives. In doing so, the Whole Foods brand became recognized by consumers across the US as synonymous with ‘natural and organic foods’.

Recently, Whole Foods fell short of analyst expectations for both sales and net income in Q2 2014, and saw its share price quickly sink nearly 14%. Despite exceeding analyst expectations for earnings per share in both Q3 and Q4, lower than expected Q3 and Q4 sales figures drove share prices down an additional 8%. This lackluster performance led to shareholder demands for revenue growth in addition to maintenance of current margins that have made Whole Foods the envy of the grocery retail industry.

Compounding these pressures are indicators that Whole Foods is maturing as a grocery retailer. The business has grown its number of stores to the point of saturation in the most affluent zip codes in the US, comprised of customers that now have access to a variety of options from competing grocery stores. An unfortunate result of this past success is that it has become increasing difficult to attract new customers and resultantly Whole Foods’ revenues per square footage of floor space has essentially plateaued.

The company’s reaction to recently heightened competition and rising consumer price sensitivity resulted in them shifting to a five facet strategy. Whole Foods plans to cut prices while matching cost cuts to maintain margins. The company will also rapidly expand store locations, from its number of locations from 385 to 1200 in the US alone, as well as updating 70% of its current locations. Simultaneously, Whole Foods first commercial campaign has been launched alongside a plan for an improved digital presence. This strategy comprises part of a larger effort to grow Whole Foods’ customer base outside of its traditional markets, consistent with recognition of a more saturated marketplace. Whole Foods knows that it’s under pressure; the once revolutionary business can no longer rely on its health-focused individuality and now has to compete under conditions of traditional grocers.

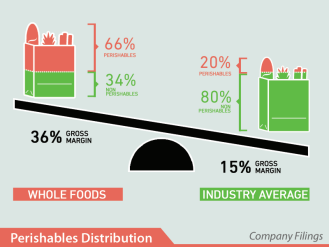

However, Whole Foods can still grow revenues driven by innovation. The company’s inventory is majorly comprised of perishable goods which provide significantly higher margins, whereas typical grocers focus on non-perishables to drive topline sales. Prepared perishable foods in particular have typical gross margins of 50% or greater, contributing a disproportionate amount to the bottom line. Indeed, Whole Foods has

already started experimenting with readymade meals, with some Whole Foods locations offering “restaurant-esque” services alongside their prepared foods, like small pubs. With employees already training in meal preparation, in conjunction with Whole Food’s close relationship with local farmers and communities, Whole Foods should look to expand beyond traditional grocery locations into the fast-casual restaurant market.

Order Up

Entering into the fast casual market with a standalone restaurant aligns with the trends towards both fast casual dining and health conscious eating in North America, exemplified by the success of restaurants likes Chipotle Mexican Grill. Fast food restaurants have increasingly come under scrutiny for unhealthy offerings, but Americans continue to demand quick meals during the day. Fast casual dining offers a healthier alternative to fast food, satisfying demands for organic and locally sourced produce. Additionally, fast casual restaurants have the ability to offer healthy, convenient meals that are more customizable, consistent with the demands young, busy, health-conscious Americans today who comprise Whole Foods’ current consumer base.

In 2010, 30% of Americans who hadn’t eaten at a fast-casual restaurant cited lack of availability for their non-participation, suggesting an unsaturated market place. According to Technomic’s 2014 Top 500 chain restaurant report, sales for fast casual chains grew by 11% and store count by 8% in 2013. This indicates that the market is still fresh and growing, with Whole Foods prime to take advantage. Moreover, adding restaurants alongside the Whole Foods grocery retail business creates a myriad of potential strategic benefits. This shift will allow the company to not only continue its strategy of rapid expansion, but to help maintain and potentially increase profit margins long term. With fast casual restaurants like Chipotle and Panera Bread having a return on assets of 16% compared to 9% for Whole Foods, the company can expect to see large potential with this new venture.

Already on the Table

The development of a standalone fast casual restaurant would require characteristics already prevalent in the company. For instance, Whole Foods already has experience making hot preprepared food, as well as restaurant quality service via its 7th Ave. Pub that was opened at Whole Foods in Hillcrest, San Diego. Whole Foods’ current prepared meal prices are sold at prices similar to the 8-15$ price range of most fast-casual meals, suggesting there will be a base-level of demand at potential restaurants and demonstrating a willingness of consumers to pay a premium for a Whole Foods’ offering. The company’s experience with in store meals gives Whole Foods a head start on menu development and expertise on hiring employees capable of preparing dishes, as well as serving them. Additionally, Whole Food’s utilization of local producers directly measures up to existing fast casual chains who thrive on the value proposition of fresh, organic ingredients. The company’s existing supply chain can be easily adapted to provide these new restaurants with the required produce.

This shift to restaurant development also falls within the company’s new corporate strategy. Whole Foods is prepared for large capital expenditure via its aggressive expansion, currently spending over $10M in capital expenditure per store. Using Chipotle as a proxy, the company could open twelve fast casual restaurants for the same price. With trivial comparative construction costs, Whole Foods should focus on providing an innovative touch to its dining experience to ensure its success. Specifically, Whole Foods should integrate its additional corporate goal of increased digital reach into its fast casual venture.

Digital Diner

It might not be expected that Whole Foods has considerable experience in hardware or software. However, the company has developed a dedicated mobile application, currently focused on providing recipes and aggregating shopping lists. Whole Foods has indicated its plan to release improvements that incorporate loyalty rewards, order-ahead, and Apply Pay. In addition, after launching its first national branding campaign, the company retrofitted its store in Alpharetta, Georgia with screens highlighting picture feeds of farms growing the store’s produce. Touch screens lined the display crates in some specialty sections, while a digital mirror encouraged shoppers to strike poses, triggering images of recommended health products. These digital elements can act as a base for Whole Food’s new restaurants.

Multiple speakers from the 2014 Fast Casual Summit highlighted the rising importance of digital and mobile experiences in fast casual restaurants, including menu boards, ordering processes, loyalty programs, and promotion. This trend is specifically important among millennial customers, who rely on various technologies for day-to-day activities and are a key customer segment to Whole Foods’ existing business. The screen experience from the Alpharetta location can be replicated in its restaurant, showcasing the produce source location, while allowing for efficiency when changing menu items based on availability. Utilizing its new mobile app, Whole Foods could allow for pre-orders while in-restaurant, decreasing wait times, while allowing for mobile payment when the customer is finally served. Finally, A panel titled, “The Big (Easy) Idea: Reaching Millennials Via Mobile!” at the 2014 Fast Casual Summit claimed that using mobile applications to track customer data and tailor promotions and discounts is becoming increasingly important to retain customers. Features like these could be made possible through the Whole Foods mobile app. By integrating their current and developing platforms into their restaurant experience, Whole Foods can gain a competitive advantage of differentiation and innovation that is synonymous with the company’s past.

Where to go for lunch?

Whole Foods current expansion strategy stems to new markets in the US, as well as expansions in both Canada and the UK. While the company is confident that it can replicate the value proposition of its business in new markets, a pivotal challenge for these planned locations is acquiring new willing customers. As locations continue to be opened in areas away from earlier established and better fitting locations, the new customer base is potentially less likely to fall into Whole Foods’ prime target consumer group – individuals with ample discretionary income and lower price sensitivity. By expanding into fast casual dining, Whole Foods can open its restaurants in its existing markets, where there is certainty of demand. This effectively allows Whole Foods to access a greater revenue per existing customer by selling them similar products, but instead as a fast meal for on-the-go, rather than groceries.

A Recipe for Success

Whole Foods has changed the grocery industry and is finally starting to feel the heat of competition. The company’s differentiating factors are not enough to give it a competitive edge, but that doesn’t mean it has to resort to typical grocery growth tactics. The company has all of the capabilities to expand into the fast casual restaurant business, utilizing its supply chain and shift toward technology to support a unique eating experience. Whole Foods has all of the ingredients to shift into this new segment and a recipe to get started. Now it’s time to start cooking.